29 2011 unclaimed financial assets no. 40 ======= laws of kenya ============= ======= the unclai

29

2011 Unclaimed Financial Assets No. 40

=======

LAWS OF KENYA

=============

=======

The Unclaimed Financial Assets

==============================

Act, 2011

=========

No. 40 of 2011

==============

Published by the National Council for Law Reporting

with the Authority of the Attorney-General

www.kenyalaw.org

THE UNCLAIMED FINANCIAL ASSETS ACT, 2011

No. 40 of 2011

Date of Assent: 2nd December, 2011

Commencement: 16th December, 2011

ARRANGEMENT OF SECTIONS

Section

Part 1—Preliminary

1—Short title.

2—Interpretation.

Part II— Determination of Unclaimed Assets

3—Unclaimed assets general requirements.

4—Travellers cheques, money orders, etc.

5—Cheques, drafts, or similar instruments.

6—Demand, savings or matured time deposits.

7—Life or endowment insurance policy or annuity contract.

8—Demutualization of insurance company, etc.

9—Deposit for utility services.

10—Determination or order by court of refund by holder.

11—Ownership interest, etc.

12— Assets from dissolved business entity.

13—Assets held in fiduciary capacity.

14—Gift certificate or credit memo.

15—Unpaid wages.

16—Assets held in safe deposit box or repository.

17—Assets held by court or Government department.

18—Cabinet Secretary to prescribe further classes of assets, etc.

Part III—Dealing With Unclaimed Assets, Duties of Holders and Certain

Powers of the Authority, etc

19—Duty to locate and notify owners of assets.

20—Report of presumed abandoned assets; duties of assets holder.

21—Authority may request for information.

22—Payment or delivery of abandoned assets to Authority.

23—Authority to assume custody; rights of assets holder, etc.

24— Authorised deductions by the Authority.

25—Dividends, interest or other income.

26—Sale of unclaimed assets.

27—Availability of information to the public.

28—Claims on assets.

29—Action to establish claim in court.

30—Expiration of time period specified by contract, statute, or court

order.

31—Report of unclaimed assets; examination of records, etc.

32—Maintenance of records; required time periods.

33—Failure to pay or deliver assets and penalties.

34— Assets deemed unclaimed before this Act came into force.

35—Duty to locate and notify owners of assets.

36—Unclaimed assets database.

37—Responsibility of regulatory authorities.

38—Access to information and retention of records by the Authority.

Part IV—The Unclaimed Financial Assets Authority

39—Establishment of the Unclaimed Financial Assets Authority.

40—Composition of the Board.

41—Objects and functions of the Authority.

42—Appointment of chief executive officer, etc.

43—Exemption from stamp duty.

Part V—The Unclaimed Financial Assets Trust Fund

44—Establishment of the Trust Fund.

45—Payment of claims.

46—Accounts and audit.

47—Penalties payable to the Fund.

48—Investment of funds.

Part VI—Miscellaneous

49—Authority to appoint agents, etc.

50—Authority may institute proceedings in court.

51—Powers of the Authority to enter, etc.

52—Offences and penalty.

53—Regulations.

THE UNCLAIMED FINANCIAL ASSETS ACT, 2011

No. 40 of 2011

AN ACT of Parliament to provide for the reporting and dealing with

unclaimed financial assets; to establish the Unclaimed Financial

Assets Authority and the Unclaimed Financial Assets Trust Fund and for

connected purposes

ENACTED by the Parliament of Kenya, as follows—

PART I—PRELIMINARY

Short title.

1. This Act may be cited as the Unclaimed Financial Assets Act, 2011.

Interpretation.

2. In this Act, unless the context otherwise requires—

“apparent owner” means the person whose name appears on the records of

the holder as the person entitled to assets held, issued, or owing by

the holder;

"assets" means financial assets to which this Act applies and includes

any income, dividend or interest thereon;

"Authority" means the Unclaimed Assets Authority established by

section 39;

"bank" has the meaning assigned to it in the Banking Act Cap. 488;

"Board" means the board of the Authority;

"Cabinet Secretary" means the Cabinet Secretary for the time being

responsible for matters relating to finance;

"chief executive officer" means the chief executive officer of the

Authority appointed under section 42;

"financial institution" has the meaning assigned to it in the Banking

Act Cap. 488;

"Fund" means the Unclaimed Assets Trust Fund established by section

44;

"holder" means any entity who, in respect to assets to which this Act

applies, holds such assets on behalf of an owner, is in possession of

assets belonging to another, is indebted to another on an obligation

or is a trustee;

"insurance company" has the meaning assigned to it in the Insurance

Act Cap. 487;

"last known address" means a description of the location of the

apparent owner sufficient for the purpose of the delivery of mail;

"owner" means a person having a legal or equitable interest in assets

subject to this Act and includes the legal representative of the

owner;

"unclaimed assets" means assets that—

(a) have been presumed abandoned and have become unclaimed assets

under the provisions of this Act;

(b) have been transferred to the Authority as unclaimed assets under

this Act;

(c) have been deemed under any other law to be unclaimed assets and

payable to the Authority,

and includes all income, dividend or interest thereon but excludes any

lawful charges thereon; and

"utility" means a person who carries on, the business of transmission,

sale, delivery, or supply of electricity, water or other utility

services.

PART II—DETERMINATION OF UNCLAIMED ASSETS

Unclaimed assets general requirements.

3. Unless otherwise provided in this Act or by any other law, assets

shall be subject to the custody of the Authority as unclaimed assets,

if the conditions raising a presumption of abandonment under sections

4 to 18 are satisfied and one or more of the following requirements

are met—

(a) the records of the holder do not reflect the identity of the

person entitled to the assets;

(b) the holder has not previously paid or delivered the assets to the

apparent owner or other person entitled to the assets;

(c) the last known address, as shown on the records of the holder, of

the apparent owner is in a country that does not provide by law for

the escheat or custodial taking of the assets or its escheat or

unclaimed assets law is not applicable to the assets and the holder is

domiciled in Kenya.

Travellers cheques, money orders, etc.

4. (1) Subject to subsection (4), any sum payable in Kenya on a

travellers cheque that is outstanding for more than two years after

its issuance is presumed abandoned unless the owner, within the two

years, has communicated in writing with the issuer concerning it or

otherwise indicated an interest as evidenced by a record prepared by

the issuer.

(2) Subject to subsection (4), any sum payable in Kenya on a money

order or similar written instrument that is outstanding for more than

two years after its issuance is presumed abandoned unless the owner,

within two years, has communicated in writing with the issuer

concerning it or otherwise indicated an interest as evidenced by a

record prepared by the issuer.

(3) A holder shall not deduct from the amount of a travellers cheque

or money order any charge imposed by reason of the failure to present

the instrument for payment unless—

(a) the issuer regularly imposes such charges and does not regularly

reverse or otherwise cancel them; and

(b) there is an enforceable written contract between the issuer and

the owner of the instrument under which the issuer may impose a

charge.

(4) A sum payable in Kenya on a travellers cheque, money order, or

similar written instrument may not be subjected to the custody of the

Authority as unclaimed assets unless one or more of the following

requirements are met—

(a) the records of the issuer show that the travellers cheque, money

order or similar written instrument was purchased in Kenya;

(b) the issuer has its principal place of business in Kenya and the

records of the issuer do not show the country in which the travellers

cheque, money order, or similar written instrument was purchased;

(c) the issuer has its principal place of business in Kenya.

Cheques, drafts or similar instruments.

5. (1) Any sum payable in Kenya on a cheque, draft, or similar

instrument, on which a bank or financial institution is directly

liable, including a banker's cheque, which is outstanding for more

than two years after it was payable or after its issuance if payable

on demand, is presumed abandoned, unless the owner, within the

immediately preceding two years, has communicated in writing with the

bank or financial institution concerning it or otherwise indicated an

interest as evidenced by a record prepared by the bank or financial

institution.

(2) A holder may not deduct from the amount of any instrument subject

to this section any charge imposed by reason of the failure to present

the instrument for payment unless—

(a) the issuer regularly imposes such charges and does not regularly

reverse or otherwise cancel them; and

(b) there is an enforceable written contract between the issuer and

the owner of the instrument under which the issuer may impose a

charge.

Demand, savings or matured time deposit.

6. (1) Any demand, savings, or matured time deposit with a bank or

financial institution, including a deposit that is automatically

renewable, and any funds paid toward the purchase of a share, a mutual

investment certificate, or any other interest in a bank or financial

institution is presumed abandoned unless the owner, within the

immediately preceding five years, has met one or more of the following

requirements—

(a) in the case of a deposit, increased or decreased its amount or

presented the passbook or other similar evidence of the deposit for

the crediting of interest;

(b) communicated, in writing, with the bank or financial institution

concerning the assets;

(c) otherwise indicated an interest in the assets as evidenced by a

record prepared by the bank or financial institution;

(d) had another relationship with the bank or financial institution

concerning which the owner has met one or more of the following

requirements—

(i) communicated, in writing, with the bank or financial institution;

(ii) otherwise indicated an interest as evidenced by a memorandum or

other record on file prepared by the bank or financial institution and

unless the bank or financial institution communicates in writing with

the owner with regard to the assets that would otherwise be abandoned

under this subsection at the address to which communications regarding

the other relationship regularly are sent.

(2) A holder may not impose with respect to assets described in

subsection (1) any charge due to dormancy or inactivity or cease

payment of interest unless—

(a) the holder regularly imposes such charges or ceases payment of

interest and does not regularly reverse or otherwise cancel them or

retroactively credit interest with respect to the assets; and

(b) there is an enforceable written contract between the holder and

the owner of the assets providing that the holder may impose a charge

or cease payment of interest.

(3) Any assets described in subsection (1) that are automatically

renewable are matured for purposes of subsection (1) seven years after

the expiration of its initial time period, but in the case of any

renewal to which the owner consents at or about the time of renewal by

communicating in writing with the bank or financial institution or

otherwise indicating consent as evidenced by a record prepared by the

holder, the assets is matured upon the expiration of the last time

period for which consent was given.

(4) Where, at the time provided for delivery to the Authority under

section 22, a penalty or forfeiture in the payment of interest would

result from the delivery of the assets, the time for delivery shall be

extended until the time when no penalty or forfeiture would result.

Life or endowment insurance policy or annuity contract.

7. (1) Funds held or owing under any life or endowment insurance

policy or annuity contract that has matured or terminated are presumed

abandoned if unclaimed for more than two years after the funds became

due and payable as established from the records of the insurance

company holding or owing the funds.

(2) Where a person other than the insured or annuitant is entitled to

the funds referred to in subsection (1) and the address of the person

is not known to the insurance company or it is uncertain from the

records of the insurance company who is entitled to the funds, it

shall be presumed that the last known address of the person entitled

to the funds is the same as the last known address of the insured or

annuitant according to the records of the insurance company.

(3) For purposes of this Act, a life or endowment insurance policy or

annuity contract not matured by actual proof of the death of the

insured or annuitant according to the records of the insurance company

shall be deemed matured and the proceeds due and payable if one or

more of the following requirements are met—

(a) the insurance company knows that the insured or annuitant has

died;

(b) the insured has attained, or would have attained if he were

living, the limiting age under the mortality table on which the

reserve is based;

(c) the policy was in force at' the time the insured attained, or

would have attained, the limiting age; and neither the insured nor any

other person appearing to have an interest in the policy within the

preceding two years, according to the records of the insurance

company, has assigned, readjusted, or paid premiums on the policy,

subjected the policy to a loan, corresponded in writing with the,

insurance company concerning the policy, or otherwise indicated an

interest as evidenced by a record prepared by the insurance company.

(4) For purposes of this Act, the application of an automatic premium

loan provision or other non-forfeiture provision contained in an

insurance policy shall not prevent a policy from being matured or

terminated under this section if the insured has died or the insured

or the beneficiary of the policy otherwise has become entitled to the

proceeds of the policy before the depletion of the cash surrender

value of the policy by the application of those provisions.

(5) Where any law or the terms of the life insurance policy require

the insurance company to give notice to the insured or owner that an

automatic premium loan provision or other non-forfeiture provision has

been exercised and the notice, given to an insured or owner whose last

known address according to the records of the insurance company is in

Kenya, is undeliverable, the insurance company shall make a reasonable

search to ascertain the policyholder's correct address to which the

notice shall be delivered.

(6) Notwithstanding any other law, where the insurance company learns

of the death of the insured or annuitant and the beneficiary has not

communicated with the insurance company within sixty days after the

death of the insured or annuitant, the insurance company shall take

reasonable steps to pay the proceeds to the beneficiary.

(7) Every change of beneficiary form issued by an insurance company

under any life or endowment insurance policy or annuity contract to an

insured or owner who is a resident of Kenya shall request all of the

following information—

(a) the name of each beneficiary, or if a class of beneficiaries is

named, the name of each current beneficiary in the class;

(b) the address of each beneficiary;

(c) relationship of each beneficiary to the insured;

(d) a copy of at least one identification document of each

beneficiary, including a national identity card or passport.

Demutualization of insurance company, etc.

8. (1) Assets distributable in the course of the demutualization of an

insurance company shall be presumed abandoned where—

(a) in the case of any funds, two years after the date of the

demutualization, the funds remain unclaimed and the owner has not

otherwise communicated with the holder or its agent regarding the

assets as evidenced by a record with the holder or its agent.

(b) in the case of any stock, two years after the date of the

demutualization, instruments or statements reflecting the distribution

are either mailed to the owner and returned as undeliverable or not

mailed to the owner because of an address on the books and records of

the holder that is known to be incorrect and the owner has not

otherwise communicated with the holder or its agent regarding the

assets as evidenced by a memorandum or other record on file with the

holder or its agent.

(2) A holder of unclaimed assets described in s section (1) shall file

an initial one-time report of unclaimed demutualization proceeds not

later than-six months after this Act comes into force.

(3) In this section, "demutualization" means the payment of

consideration for the relinquishment of a mutual membership interest

in a mutual insurance company, whether or not undertaken in

conjunction with a plan of demutualization, liquidation, merger, or

other form of reorganization.

Deposit for utility services.

9. A deposit made by a subscriber with a utility to secure provision

of services or any sum paid in advance for utility services to be

furnished, that remains unclaimed by the owner for more than two years

after termination of the services for which the deposit or advance

payment was made shall be presumed abandoned.

Determination or order by court of refund by holder.

10. Except to the extent otherwise ordered by a court, any sum that a

holder has been ordered to refund by a court that remains unclaimed by

the owner for more than two years after it became payable in

accordance with the final determination providing for the refund,

whether or not the final determination requires any person entitled to

a refund to make a claim for the refund, is presumed abandoned.

Ownership interest, etc.

11. (1) Any stock, share, or other intangible ownership interest in a

business entity, the existence of which is evidenced by records

available to the entity, is presumed abandoned and, with respect to

the interest, the entity is the holder, if both of the following

apply—

(a) the interest in the entity is owned by a person who for more than

three years has not claimed a dividend, distribution, or other sum

payable as a result of the interest, or who has not communicated with

the entity regarding the interest or a dividend, distribution, or

other sum payable as the result of the interest, as evidenced by a

memorandum or other record on file with the entity prepared by the

entity;

(b) the entity does not know the whereabouts of the owner at the end

of the three year period.

(2) The return of official shareholder notifications or communications

as undeliverable is evidence that the entity does not know the

location of the owner.

(3) This section applies to both the underlying stock, share, or other

intangible ownership interest of an owner, and any stock, share, or

other intangible ownership interest of which the business entity is in

possession of the certificate or other evidence or indication of

ownership, and to the stock, share, or other ownership interest of

dividend and non-dividend paying business entities whether or not the

interest is represented by a certificate.

(4) At the time an interest is presumed abandoned under this section,

any dividend, distribution, or other sum then held for or owing to the

owner as a result of the interest, and not previously presumed

abandoned, shall be presumed abandoned.

Assets from dissolved business entity.

12. Assets distributable in the course of dissolution of a business

entity that remain unclaimed by the owner for more than two years

after the date specified for final distribution is presumed abandoned.

Assets held in fiduciary capacity.

13. (1) Assets held in a fiduciary capacity for the benefit of another

person are presumed abandoned unless the owner, within two years after

they have become payable or distributable, has increased or decreased,

the principal, accepted any payment in respect thereof, communicated

concerning the assets, or otherwise indicated any other interest as

evidenced by a record prepared by the fiduciary.

(2) For the purposes of this Act, a person who is deemed to hold

assets in a fiduciary capacity for a business entity alone is the

holder of the assets only insofar as the interest of the business

entity in the assets is concerned, and the business entity is the

holder of the assets insofar as the interest of any other person in

the assets is concerned.

Gift certificate or credit memo.

14. (1) Except as provided in subsection (4), a gift certificate, gift

card, or credit memo is presumed abandoned if either of the following

apply—

(a) the certificate, card, or memo is not claimed or used for a period

of five years after becoming payable or distributable;

(b) the certificate, card, or memo was used or claimed one or more

times without exhausting its full value, but subsequently was not

claimed or used for an uninterrupted period of five years.

(2) For purposes of subsection (1), a gift certificate or gift card is

considered to have been claimed or used if there is any transaction

processing activity on the gift certificate or gift card including,

but not limited to, redeeming, refunding, or adding value to the

certificate or card.

(3) Activity initiated by the issuer of the certificate or card,

including, but not limited to, assessing inactivity fees or similar

service fees, does not constitute transaction processing activity for

purposes of subsection (2).

(4) In the case of a gift certificate or gift card, the owner is

presumed to be a recipient of the gift certificate or gift card, and

the amount presumed abandoned is the price paid by the purchaser

for-the gift certificate or gift card, less the total of any purchases

or fees assessed a 'fist the certificate or card.

(5) In the case of a credit memo, the amount presumed abandoned is the

amount credited to the recipient of the memo.

(6) This Act does not apply to a gift certificate that is issued for

retail goods or services by a person engaged in the retail sale of

goods or services.

Unpaid wages.

15. Unpaid wages including wages represented by unpresented payroll

cheques, allowances, bonuses and terminal benefits owing in the

ordinary course, of the holder's business that remain unclaimed by the

owner for more than one year after becoming payable are presumed

abandoned.

Assets held in safe deposit box or repository.

16. Assets that by their nature may lawfully be sold, held in a safe

deposit box or any other safekeeping repository in Kenya in the

ordinary course of the holder's business, and proceeds resulting from

the sale of the assets, that remain unclaimed by the owner for more

than two years after the lease or rental period on the box or other

repository has expired, are presumed abandoned.

Assets held by court or Government department.

17. Assets held for the owner by a court or a Government department

that remains unclaimed by the owner for more than one year after

becoming payable or distributable is presumed abandoned.

Cabinet Secretary to prescribe further classes of assets etc.

18. (1) Subject to this Act, the Cabinet Secretary may by order in the

Gazette prescribe such further class of assets and such further class

of holders to be assets and holders respectively to which this Act

applies.

(2) The order referred to subsection (1) shall include such other

requirements as the Cabinet Secretary may deem necessary, including

the period after which assets referred to in subsection (1) may be

presumed abandoned and deemed unclaimed assets.

PART III—DEALING WITH UNCLAIMED ASSETS, DUTIES OF HOLDERS AND CERTAIN

POWERS OF THE AUTHORITY, ETC.

Duty to locate and notify owners of assets.

19. (1) A holder of assets to which this Act applies shall make all

reasonable efforts to locate the owner and to notify the owner about

those assets.

(2) The reasonable efforts required under subsection (1) shall be made

in such manner and within such period as the Authority may prescribe.

(3) Without prejudice to the generality of subsections (1) and (2),

within a period not less than sixty days and not more than one year

before filing the report required by section 20, the holder in

possession of assets presumed abandoned and subject to the Authority's

custody as unclaimed assets under this Act shall send written notice

to the apparent owner at his last known address informing him that the

holder is in possession of assets subject to this Act where the holder

has in its records an address of the apparent owner.

Report of presumed abandoned assets; duties of assets holder.

20. (1) A person holding assets presumed abandoned and subject to the

custody of the Authority as unclaimed assets under this Act shall make

a report concerning the assets to the Authority as provided in this

section.

(2) The report referred to in subsection (1) shall be certified by the

chief executive officer of the holder and shall include all of the

following—

(a) the name, if known, and last known address, if any, of each person

appearing from the records of the holder to be the owner of assets

presumed abandoned under this Act;

(b) in the case of unclaimed assets held or owing under any life or

endowment insurance policy or annuity contract, the full name and last

known address of the insured or annuitant and of the beneficiary

according to the records of the insurance company holding or owing the

assets;

(c) in the case of the contents of a safe deposit box or other

safekeeping repository or of other tangible assets, a description of

the assets and the place where they are held and may be inspected by

the Authority and any amounts owing to the holder;

(d) the nature and identifying number, if any, or description of the

assets and the amount appearing from the records to be due;

(e) the date the assets became payable, demandable, or returnable, and

the date of the last transaction with the apparent owner with respect

to the assets;

(f) other information the Authority may lawfully require.

(3) Where the person holding assets presumed abandoned and subject to

the Authority's custody as unclaimed assets under this Act is a

successor to other persons who previously held the assets for the

apparent owner, or the holder has changed its name while holding the

assets, the holder shall file with the report all known names,

addresses and any other particulars of each previous holder of the

assets.

(4) Except as otherwise provided in this section, the report referred

to in subsection (1) shall be filed on or before the first day of

November of each year for the twelve-month period ending on the

immediately preceding thirtieth day of June.

(5) The Authority may extend the filing date provided for in

subsection (4) for up to sixty days after the deadline if an estimated

payment is paid on or before the deadline for the twelve-month period

ending on the immediately preceding thirtieth of June.

(6) A request for extension of time to file the report shall not be

deemed a request for an extension of time to remit payments.

(7) The Authority shall determine how estimated payments are to be

remitted to it by a holder under this Act.

Authority may request for information.

21. For the purposes of this Act, the Authority may request a person

who the Authority reasonably believes is a holder of assets to provide

such information to the Authority as the Authority may require, within

such time or at such intervals as may be specified in the request.

Payment or delivery of abandoned assets to Authority.

22. A person who is required to file a report under section 20 shall

at the time of filing the report pay or deliver to, or hold to the

order of the Authority all abandoned assets that are required to be

reported under that section or any balance owing if an estimated

payment was earlier made to the Authority.

Authority to assume custody; rights of assets holder, etc.

23. (1) Upon the payment or delivery of assets to the Authority, the

Authority shall assume custody and responsibility for the safekeeping

of the assets.

(2) A person who pays or delivers assets to the Authority in good

faith shall be relieved of all liability to the extent of the value of

the assets paid or delivered for any claim then existing or which may

arise or be made in respect to the assets after the payment or

delivery to the Authority.

(3) Where the holder pays or delivers assets to the Authority in good

faith and another person claims the assets from the holder or another

country claims the money or assets under its laws relating to escheat

or abandoned or unclaimed assets, the Authority, upon written notice

of the claim, shall defend the holder against the claim and indemnify

the holder against any liability on the claim.

(4) For the purposes of this section, "good faith" means—

(a) that payment or delivery was made in a reasonable attempt to

comply with this Act;

(b) that the person delivering the assets was not a fiduciary then in

breach of trust in respect to the assets and had a reasonable basis

for believing, based on the facts then known to him, that the assets

was abandoned for the purposes of this Act; and

(c) that there is no indication that the records under which the

delivery was made did not meet reasonable commercial standards of

practice in the industry.

(5) Assets removed from a safe deposit box or other safekeeping

repository shall be received by the Authority subject to the holder's

right under this subsection to be reimbursed for the actual cost of

the opening and to any valid lien or contract providing for the holder

to be reimbursed for unpaid rent or storage charges.

(6) The Authority shall reimburse or pay the holder out of the

proceeds remaining after deducting the Authority's selling cost of an

asset under this Act.

Authorised deductions by the Authority.

24. (1) Before making any deposit to the credit of the Fund, the

Authority may deduct any of the following—

(a) costs in connection with the sale of abandoned assets;

(b) costs of mailing and publication in connection with any abandoned

assets;

(c) reasonable service charges;

(d) costs incurred in examining records of holders of assets and in

collecting the assets from those holders.

(2) The Authority shall ensure that the costs and charges deducted

pursuant to subsection (1) are reasonable and in accordance with the

best market value available.

(3) Notwithstanding subsection (2), the charges deducted under

subsection (1) (c) shall not exceed one per cent of the gross value of

the asset in question.

Dividends, interest or other income.

25. Where assets other than money is delivered to the Authority under

this Act, the owner shall be entitled to receive from the Authority

any dividends, interest, or other income realized or accruing on the

assets at or before liquidation or conversion of the assets into

money.

Sale of unclaimed assets.

26. (1) Except as provided in this section, the Authority, not later

than three years after the receipt of the abandoned assets referred to

in section 25, shall sell such assets, subject to a reserve price, to

the highest bidder at a public auction.

(2) Any sale held under this section shall be preceded by at least one

publication of notice, at least three weeks in advance of sale, in at

least one newspaper of national circulation.

(3) Securities listed on a stock exchange shall be sold by the

Authority at prices prevailing at the time of sale on the exchange.

(4) Securities not listed on a stock exchange may be sold over the

counter at prices prevailing at, the time of sale or by any such other

method as the Authority may consider appropriate.

(5) Unless the Authority considers it to be in the best interest of

the Fund to do otherwise, all securities presumed abandoned under this

Act and delivered to the Authority shall be sold within one year of

the receipt of the securities.

(6) The purchaser of assets at a sale conducted by the Authority under

this Act shall take the assets free of all claims of the owner or

previous holder of the assets and of all persons claiming through or

under the owner or previous holder.

(7) The Authority shall execute all documents necessary to complete

the transfer of ownership to the purchaser.

Availability of information to the public.

27. The Authority shall, upon payment of such inspection fee as the

Authority may from time to time determine; make available for public

inspection at all business hours, only the name of the owner or

apparent owner and a general description of the assets delivered to it

under this Act.

Claims on assets.

28. (1) A person claiming an interest in any assets paid or delivered

to the Authority under this Act, may file with the Authority a claim

on such form as may be prescribed for that purpose by the Authority.

(2) The Authority shall consider each claim referred to subsection (1)

within ninety days after it is filed and shall give written notice to

the claimant of its decision.

(3) The notice under subsection (2) may be given by mailing it to the

last address, if any, stated in the claim as the address to which

notices are to be sent.

(4) Where no address for notices is stated in the claim, the notice

may be mailed to the last address, if any, of the claimant as stated

in the claim.

(5) Where a claim is allowed, the Authority shall pay over or deliver

to the claimant the assets or the amount the Authority actually

received or the net proceeds if it has been sold by the Authority.

Action to establish claim in court.

29. (1) A person who is aggrieved by a decision of the Authority or

whose claim has not been acted upon within ninety days after its

filing may bring an action in court against the Authority.

(2) The action shall be brought within ninety days after the decision

of the Authority or within one hundred and eighty days after the

filing of the claim where the Authority has failed to Act on a claim.

Expiration of time period specified by contract, statute of court

order.

30. The expiration, before or after the commencement of this Act, of

any period of time specified by contract, statute, or court order,

during which a claim for assets can be made or during which an action

or proceeding may be commenced or enforced to obtain payment of a

claim' for money or to recover assets, shall not prevent the assets

from being presumed abandoned or affect any duty to file a report or

to pay or deliver abandoned assets to the Authority as required by

this Act and such assets shall be delivered to the Authority and dealt

with as unclaimed assets under this Act.

Report of unclaimed assets; examination of records, etc.

31. (1) The Authority shall have powers to require a person who has

not filed a report as required by section 20 or a person who the

Authority believes has filed an incomplete, or false report, to file a

certified report in a form specified by the Authority.

(2) The report under section (1) shall state whether the person is

holding any unclaimed assets reportable or deliverable under this Act,

describe unclaimed assets not previously reported or as to which the

Authority has made inquiry, and specifically identify and state the

amounts of assets that may be in issue.

(3) The Authority shall have powers to, at reasonable times and upon

reasonable notice, examine the records of a person to determine

whether the person has complied with this Act.

(4) The Authority shall have powers to conduct the examination

referred to in subsection (3) whether or not the person believes he or

she is not in possession of any assets reportable or deliverable under

this Act.

(5) The Authority shall have powers to enter into contract with any

other person to conduct the examination under this section on behalf

of the Authority.

(6) Where an examination of the records of a person results in the

disclosure of assets reportable and deliverable under this Act, the

Authority shall have powers to assess the cost of the examination

against the holder at such daily rate as the Cabinet Secretary may

determine provided that the charges shall not exceed the value of the

assets found to be reportable and deliverable.

(7) The cost of examination made pursuant to subsection (3) shall be

imposed only against the holder.

(8) Where after this Act comes into force, a holder fails to maintain

the records required by section 31 and the records of the holder

available for the periods subject to this Act are insufficient to

permit the preparation of a report, the Authority shall have powers to

require the holder to report and pay an amount as may reasonably be

estimated from any available records.

Maintenance of records; required time periods.

32. (1) A holder required to file a report under section 20, as to any

assets for which it has obtained the last known address of the owner,

shall maintain a record of the name and last known address of the

owner for ten years after the assets becomes reportable, except to the

extent that a shorter time is provided in subsection (2) or by the

Authority.

(2) An entity that sells in Kenya its travellers cheques, money

orders, or other similar written instruments on which the business

entity is directly liable, or that provides those instruments to

others for sale in Kenya, shall maintain a record of those instruments

while they remain outstanding, indicating the country and date of

issue for three years after the date the assets are reportable.

Failure to pay or deliver assets and penalties.

33. (1) A person who fails to pay or deliver assets within the time

prescribed by this Act shall pay to the Authority interest at the

current monthly rate of one percentage point above the adjusted prime

rate per annum per month on the assets or value of the assets from the

date the assets should have been paid or delivered.

(2) The adjusted prime rate shall be based on the Central Bank of

Kenya average rate during the twelve-month period ending on thirtieth

day of September.

(3) The resulting current monthly interest rate based on the

twelve-month period ending thirtieth day of September shall become

effective on the first day of January of the following year.

(4) A person who willfully fails to render any report or perform other

duties required under this Act shall be liable to pay penalty of seven

thousand shillings but not more than fifty thousand shillings for each

day the report is withheld or the duty is not performed.

(5) A person who willfully fails to pay or deliver assets to the

Authority as required under this Act shall be liable to pay a penalty

equal to twenty-five percent of the value of the assets that should

have been paid or delivered.

(6) A penalty payable under subsections (1), (4) and (5) of this

section shall be recoverable as civil debt summarily.

Assets deemed unclaimed before this Act came into force.

34. (1) This Act shall, on coming into force, apply to all assets that

would, but for the absence of this Act, be deemed unclaimed assets

under the provisions of this Act as if this Act had been in force at

that earlier date on which the assets would have become unclaimed

assets under this Act.

(2) The initial report filed under this Act for assets that are

subject to this Act shall include all assets that would have been

presumed abandoned before this Act came into force as if this Act had

been in effect during that period and such assets shall be dealt with

under the provisions of this Act.

Duty to locate and notify owners of assets.

35. (1) The Authority shall make reasonable efforts to locate the

owner of assets in the custody of the Authority and notify him in

accordance with this Act.

(2) In notifying an owner as required by subsection (1), the Authority

shall determine the most cost effective manner of making the

notification depending on the respective value of the assets

concerned.

Unclaimed assets database.

36. The Authority shall—

(a) maintain an electronic or other database of all unclaimed assets

submitted to it under this Act;

(b) include in the database the prescribed particulars for each

unclaimed asset;

(c) make the database available to the public, subject to any

restrictions imposed for purposes of protecting the privacy of owners.

Responsibility of regulatory authorities.

37. (1) Any regulatory authority responsible for the supervision of a

holder shall assist the Authority in the enforcement of the provisions

of this Act and generally ensure that the objectives of this Act are

achieved.

(2) Subject to section 3, where there is conflict between the

provisions of this Act and the provisions of any other law on any

matter concerning unclaimed assets, the provisions of this Act shall

prevail.

Access to information and retention of records by the Authority.

38. (1) Subject to any other written law to the contrary, the

Authority shall have the right to any information that is in the

custody or control of a public body if that information can reasonably

be expected to assist the Authority in locating the owner, or

determining the correct owner, of an unclaimed asset for the purposes

of this Act.

(2) A public body that has custody or control of information to which

the Authority is entitled under subsection (1) shall disclose that

information to the Authority on request.

(3) Each public body shall meet the standards, as may be set by

regulation, with respect to—

(a) the collection and recording of information concerning any assets

that become unclaimed assets; and

(b) retention of records containing that information.

PART IV—THE UNCLAIMED FINANCIAL ASSETS AUTHORITY

Establishment of the Unclaimed Financial Assets Authority.

39. (1) There shall be an authority to be known as the Unclaimed

Financial Assets Authority.

(2) The Authority is a body corporate with perpetual succession and a

common seal and shall, in its corporate name, be capable of—

(a) suing and being sued;

(b) taking, purchasing or otherwise acquiring, holding, charging or

disposing of movable and immovable property;

(c) borrowing money or making investments;

(d) entering into contracts; and

(e) doing or performing all other acts or things for the proper

performance of its functions under this Act which may lawfully be done

or performed by a body corporate.

(3) The Authority shall perform the functions assigned to the

Authority under this Act.

Composition of the Board.

40. (1) The Board of the Authority shall comprise—

(a) five persons not being public officers appointed by the Cabinet

Secretary of whom—

(i) one shall be appointed by virtue of his knowledge and experience

in matters relating to banking and investment;

(ii) one shall be appointed by virtue of his knowledge and experience

in matters relating to insurance;

(iii) one shall be appointed by virtue of his knowledge and experience

in matters relating to accounting and auditing, law, corporate or

business management and,

(iv) one shall be appointed by virtue of his knowledge in matters

relating to unclaimed assets

(v) one shall be appointed to represent the interest of consumers of

financial services;

(b) the permanent secretary to the Treasury;

(c) the chief executive officer.

(2) The members of the Board shall, at their first meeting, elect a

chairperson from amongst the members of the Board appointed under

subsection (1) (a).

(3) No person shall be appointed as a member of the Board under

subsection (1) (a) if such person-

(a) has been convicted of an offence by a court of competent

jurisdiction and sentenced to imprisonment for a term of six months or

more;

(b) is adjudged bankrupt or has entered into a composition scheme or

arrangement with his creditors; or

(c) is disqualified under the provisions of any other written law from

appointment as such.

(4) A member of the Board shall hold office for a period of three

years, but shall be eligible for re-appointment.

(5) A member of the Board under subsection (1)(a) may—

(a) at any time resign from office by notice in writing to the Cabinet

Secretary; or

(b) be removed from office by the Cabinet Secretary if the member—

(i) has been absent from three consecutive meetings of the Board

without justifiable cause or the permission of the chairperson;

(ii) is adjudged bankrupt or enters into a composition scheme or

arrangement with his creditors; or

(iii) is convicted of an offence involving dishonesty or fraud;

(iv) subject to paragraph (iii), is convicted of a criminal offence

and sentenced to imprisonment for a term of six months or more;

(v) is incapacitated by prolonged physical or mental illness; or

(vi) is otherwise unable or unfit to discharge his functions.

(6) The quorum for any meeting of the Board shall be three.

(7) All questions proposed at a meeting of the Board shall be decided

by a majority of the votes of the members present and voting, and in

the event of equality of votes, the chairperson or the person

presiding shall have a casting vote in addition to the deliberative

vote.

(8) The Board may act notwithstanding any vacancy among the

membership.

(9) Subject to this Act, the Board may make rules for regulating the

procedure at its meetings.

(10) The seal of the Authority shall be authenticated by the signature

of the chairperson of the Board and the Chief Executive Officer and

any document not required by law to be under seal and all decisions of

the Board may be authenticated by the chairperson and the Chief

Executive Officer:

Provided that the Board shall, in the absence of either the

chairperson or the Chief Executive Officer, in any particular case or

for any particular matter, nominate one of their own, in the

particular case or matter in respect of which he is nominated,

authenticate the seal of the Board on behalf of either the chairperson

or the Chief Executive Officer.

Objects and functions of the Board.

41. The objects and functions of the Authority shall be to—

(a) enforce, and generally administer, the provisions of this Act;

(b) act as the Trustee to the Fund in accordance with Part V of this

Act;

(c) receive all payments required by this Act to be made to the Fund;

(d) make payments out of the Fund to the rightful owners in accordance

with the provisions of this Act;

(e) manage and invest the funds of the Authority;

(f) advise the Cabinet Secretary on the national policy to be followed

with regard to unclaimed assets and to implement all government

policies relating to it; and

(g) perform such other functions as are conferred on it by this Act or

by any other written law.

Appointment of the chief executive officer, etc.

42. (1) The Board shall, through a competitive process, appoint a

chief executive officer who shall hold office on such terms and

conditions of service as may be specified in the instrument of

appointment.

(2) The Chief Executive Officer shall be the managing trustee of the

Fund.

(3) The Chief Executive Officer shall be responsible to the Board for

the management of the day to day affairs of the Authority.

(4) The Board shall have power to appoint on such terms and conditions

of service as it may determine, such other officers, servants and

agents of the Fund as may be necessary for the efficient

administration of the Fund and the Board shall exercise disciplinary

control over such officers, servants and agents.

(5) The Board may, subject to such Conditions as the Board may think

fit, by directions in writing, delegate any of its powers under

subsection (4) to any one or more of the members of the Board or to

the Chief Executive Officer or other officer of the Fund.

Exemption from stamp duty.

43. No duty shall be chargeable under the Stamp Duty Act Cap. 480 in

respect of any instrument executed by any person on behalf of or in

favour of the Fund or in respect of the payment of any benefit or the

refunding of any amount under this Act in any case where, but for this

exemption, the Fund or any person acting on behalf of the Authority.

PART V—THE UNCLAIMED FINANCIAL ASSETS TRUST FUND

Establishment of the Trust Fund.

44. (1) There shall be a Fund known as the Unclaimed Assets Trust Fund

which shall vest in, and be operated and managed by, the Authority.

(2) There shall be paid—

(a) into the Fund, all moneys that become or are deemed to be

unclaimed assets and other payments required by this Act or by any

other written law to be paid into the Fund; and

(b) out of the Fund—

(i) payment due and payable to owners out of the Fund under the Act;

(ii) such amounts as may be approved by the Cabinet Secretary to

defray costs associated with the administration of the Authority and

performance of its functions under this Act.

Payment of claims.

45. (1) Where the Authority is satisfied that a person is the owner of

all or part of the assets that became unclaimed assets and paid into

the Fund, the Authority may pay out of the Fund to the owner an amount

equal to the value of that assets or part of that assets as the case

may be.

(2) No interest or other earning accrues or is payable to an owner in

respect of the period after assets becomes unclaimed assets and

delivered to the Authority under this Act.

(3) A payment under this section to an owner shall discharge the

Authority from liability to the owner in respect of the assets that

became unclaimed assets and were actually paid into the Fund.

Accounts and audit.

46. (1) The Authority shall cause to be kept all proper books of

account and other books and records in relation to the Fund and to all

the undertakings, funds, investments, activities and property of the

Fund as the Authority may deem necessary.

(2) Within a period of three months after the end of each financial

year, the Authority shall prepare, sign and transmit to the

Auditor-General or to an auditor appointed under subsection (3)—

(a) a balance sheet showing in detail the assets and liabilities of

the Fund;

(b) a statement of income and expenditure of the Fund; and

(c) such other statements of account as the Authority may deem

necessary.

(3) The accounts of the Fund shall be audited and reported upon in

accordance with the Public Audit Act No. 12 of 2003, by the

Auditor-General, or by an auditor appointed by the Authority under the

authority of the Auditor-General.

(4) The Authority shall cause the audited accounts of the Fund to be

published in the Gazette and in at least two newspapers with national

circulation.

Penalties payable to the Fund.

47. (1) The Court before whom any person is convicted of an offence

under this Act may, without prejudice to any civil remedy, order such

person to pay to the Fund the amount of any other sum, together with

any interest or penalty thereon, found to be due from such person to

the Fund, and any sum so ordered shall be recoverable as a fine and

paid into the Fund.

(2) All sums due to the Fund shall be recoverable as debts due to the

Authority and without prejudice to any other remedy shall be a civil

debt recoverable summarily.

Investment of funds.

48. (1) All moneys in the Fund which are not for the time being

required to be applied for the purposes of the Fund shall be invested

in such investments, being investments in which any trust fund (or

part thereof) is permitted by the Trustee Act Cap. 167 to be invested,

as may be determined by the Authority with the approval of the Cabinet

Secretary.

(2) All investments made under this section shall be held for and on

behalf of the Fund in the name of the Authority.

PART VI—MISCELLANEOUS

Authority to appoint agents, etc.

49. The Authority may appoint or license such agents and service

providers as it may deem necessary for the carrying out of the objects

of this Act and may in that respect and without prejudice to the

foregoing appoint custodians, fund managers and reunification agents

to assist in the reunification of the assets with the owners.

Authority may institute proceedings in court.

50. All criminal and civil proceedings under this Act may, without

prejudice to any other power in that behalf, be instituted by

Authority and, where the proceedings are instituted or brought in a

court, an officer of the Authority authorised by the Board in that

behalf may prosecute or conduct the proceedings.

Powers of the Authority to enter, etc.

51. (1) The Authority shall, for the purpose of ascertaining whether

this Act is being or has been complied with by any person, have power

to enter any premises or place at all reasonable times.

(2) An institution liable to inspection under this Act, and any

employee, shall furnish the Authority all such information and produce

for inspection all such documents as the Authority may reasonably

require for the purpose of performing its functions under this Act.

Offences and penalty.

52. (1) A holder who—

(a) fails to maintain a record required under this Act or the

Regulations made thereunder;

(b) in a record required or submitted, or in information provided,

under this Act or the Regulations, makes a statement that—

(i) is false or misleading with respect to a material particular; or

(ii) omits to state a material fact, the omission of which makes the

statement false or misleading, commits an offence.

(2) A person is not guilty of an offence under subsection (1) (b) if

the person did not know that the statement was false or misleading

and, with the exercise of reasonable diligence, could not have known

that the statement was false or misleading.

(3) Where a body corporate commits an offence under this section, an

employee, officer, director or agent of the corporation who

authorises, permits or acquiesces in the commission of the offence

commits an offence.

(4) Subsection (3) shall apply whether or not the body corporate is

prosecuted for the offence.

(5) A person who wilfully refuses after written demand by the

Authority to pay or deliver assets to the Authority as required under

this Act commits an offence.

(6) A person Convicted of an offence under this section shall be

liable to a fine of not less than fifty thousand shillings and not

more than one million shillings or to imprisonment for not more than

one year, or to both.

Regulations.

53. The Cabinet Secretary may, on the recommendation of the Board,

make regulations necessary to carry out the provisions of this Act.

0 METWSG1SN NO 9 METWSG1SN NO 9 241007 METEOROLOGICAL

0 METWSG1SN NO 9 METWSG1SN NO 9 241007 METEOROLOGICAL TROUVER DES OCCASIONS DAFFAIRES ET FOURNIR DES BIENS ET

TROUVER DES OCCASIONS DAFFAIRES ET FOURNIR DES BIENS ET REFLEXIVE VERBS REVIEW T O LEARN TO CONJUGATE REFLEXIVE

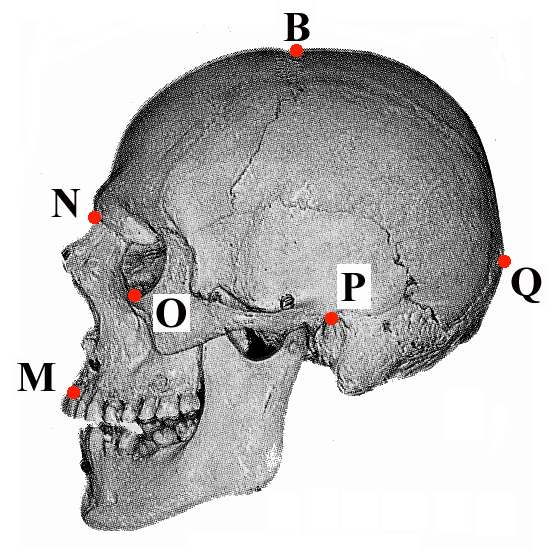

REFLEXIVE VERBS REVIEW T O LEARN TO CONJUGATE REFLEXIVE CRÂNIOMÉTRIE QUELLES MESURES FAIRE SUR UN CRÂNE ?

CRÂNIOMÉTRIE QUELLES MESURES FAIRE SUR UN CRÂNE ? FT POSTDOCTORAL FELLOW INTERIM CURATORANTHROPOCENE THE CARNEGIE MUSEUM OF

FT POSTDOCTORAL FELLOW INTERIM CURATORANTHROPOCENE THE CARNEGIE MUSEUM OF ZAŁĄCZNIK NR 2 DEKLARACJA O REZYGNACJI Z DOKONYWANIA WPŁAT

ZAŁĄCZNIK NR 2 DEKLARACJA O REZYGNACJI Z DOKONYWANIA WPŁAT UNIVERSIDAD AUTÓNOMA DE BAJA CALIFORNIA COORDINACIÓN Y DEPARTAMENTOS DE

UNIVERSIDAD AUTÓNOMA DE BAJA CALIFORNIA COORDINACIÓN Y DEPARTAMENTOS DE CONCURSO NACIONAL DE ANTEPROYECTOS “HACIA UNA NUEVA ARQUITECTURA ESCOLAR”

CONCURSO NACIONAL DE ANTEPROYECTOS “HACIA UNA NUEVA ARQUITECTURA ESCOLAR” Nº PROCEDIMIENTO 030622 CÓDIGO SIACI SKKG CONSEJERÍA DE FOMENTO

Nº PROCEDIMIENTO 030622 CÓDIGO SIACI SKKG CONSEJERÍA DE FOMENTO wrapa_valid_licensees

wrapa_valid_licensees