competitive and organisational constraints on innovation, investment and quality of care in a liberalised low-income health system: evidence

Competitive and organisational constraints on innovation, investment

and quality of care in a liberalised low-income health system:

evidence from Tanzania

Maureen Mackintosh* and Paula Tibandebage**

* Professor of Economics

Department of Economics,

Faculty of Social Sciences,

The Open University,

Walton Hall,

Milton Keynes MK7 6AA,

UK

[email protected]

** Training co-ordinator

Research on Poverty Alleviation (REPOA),

P.O. Box 33223

Dar es Salaam,

Tanzania

[email protected]

Word length 8103

Acknowledgements

Research for this paper was funded by the UK Department for

International Development (DFID) and by the Open University. We thank:

participants in workshops in Dar es Salaam, London, Cambridge and

Johannesburg; Lucy Gilson, Gavin Mooney, Samuel Wangwe and Marc Wuyts;

also the following researchers and consultants on the project: A.D.

Kiwara, P. Mujinja, P. Ngowi, G. Nyange, V. Mushi, J. Andrew and F.

Meena. We are grateful to everyone in the fieldwork districts who gave

their time to facilitate our research. The opinions expressed here are

solely those of the authors, and do not represent the policies and

practices of the DFID.

Competitive and organisational constraints on innovation, investment

and quality of care in a liberalised low-income health system :

Tanzanian evidence

Maureen Mackintosh and Paula Tibandebage

International health policy proposals increasingly emphasise health

system strengthening and innovation. In a context of liberalised

provision, the scope for innovative health system rebuilding depends

on the viability, effectiveness and capabilities of the

non-governmental providers. Yet the research literature examining the

market behaviour of private health care firms in developing countries,

and the incentive structures and constraints they face, remains

limited. We demonstrate here the extent of perverse health care market

dynamics found in Tanzania in the late 1990s, in relation to patients’

need for reliable health care, and show that the financial and

operating fragility of the firms constrained investment and

innovation. We aim to focus attention on the challenge for innovative

approaches to poverty reduction represented by the current market and

business structure of health care in low income countries and to

discuss some policy implications.

INTRODUCTION

There is now international recognition, in the policy literature on

poverty alleviation and the problems of attaining the Millennium

Goals, of the importance of health system strengthening in developing

countries and notably in Sub-Saharan Africa (Pearson 2004; Freedman et

al 2005). Associated with this theme is an emerging emphasis on the

relevance of innovation in health system organisation and behaviour to

achieving health improvement (Janovsky and Peters 2006). Given the now

widespread recognition of the scale of private funding and provision

in health care in low and middle income countries, innovative health

system rebuilding necessarily involves an important role for

non-governmental providers (Bloom 2004; Bennett et al 2005).

The range of current policies towards private sector innovation in

African health systems is large. It includes promotion of private

corporate investment in African health systems, as in the 2006

International Finance Corporation initiative1; supportive and

regulatory initiatives to change small providers’ behaviour, such as a

Tanzanian Food and Drugs Authority initiative to train staff, accredit

and locally monitor a network of rural drug shops; and numerous small

scale insurance initiatives. All such initiatives require robust

information about market and business structure in order to be

effective; however the field research-based and analytical literature

on the operation of the private health sector in developing countries

remains thin (Bloom 2004, Bloom and Standing 2001; Mackintosh and

Koivusalo 2005a, Leonard 2000; Söderlund et al 2003; Bennett et al

1997).

We do know however that in low income Africa as in a number of other

low income countries, two key features of the current liberalised

health care markets interact in ways that may be damaging. First,

health care is dominated in all sectors by formal and informal fee-for

service provision. Exceptions include the removal of primary care fees

in the public sector in Uganda and a national health insurance system

designed to end ‘cash and carry’ in the Ghana Health Service. But in

general, the poorer a country, the larger the expected share of health

funding represented by out-of-pocket spending (Mackintosh and

Koivusalo 2005b). In Tanzania an estimated 45% of all health care

spending is private expenditure, largely out of pocket2.

Second, liberalisation of clinical provision has been associated with

the expansion of informalised private provision on which large numbers

of poor people depend. By ‘informalisation’, we mean a lack of

enforcement of basic regulatory constraint including registration

requirements; very poor clinical oversight and supervision; absence of

quality assurance in provision and medicine sales; and at worst, a

shift of health care into an informal sector of unlicensed, unstable

and abusive services and drug sales (Bloom and Standing 2002; Asiimwe

2003; Mujinja et al 2003). The implications for care appear to be

worst, as economic theory would lead us to expect, at the

lowest-charging, lowest-income end of provision: employment of often

under-skilled or almost unskilled staff, use of medicines of doubtful

quality, over-charging and patterns of abuse (Tibandebage and

Mackintosh 2002, 2005) 3.

This combination of charging system and provider behaviour has

resulted in a crisis of access and quality of health care that was

severe even before the recent wave of out-migration of health

professionals from low income countries (Freedman et al 2005; Save the

Children 2005; Mensah et al 2005). In this paper, we draw on case

studies of the financial situation and business strategies of

non-governmental health facilities in Tanzania in response to market

incentives to argue the following.

We show that quality of care was a major casualty of price-focused

competition at the lower end of the health care market. Provision by

skilled professionals tended to be squeezed out, as did the scope

within private and non-profit providers for cross-subsidy of public

health activity from fee income. In association with health

businesses’ very precarious financial status, these market pressures

were severely undermining the scope for innovative provision and

investment by committed staff and investors. Only facilities serving

the small upper end of the market, or those receiving substantial

subsidy and using it effectively, could withstand some of these

pressures: commitment alone was not enough. Policies that aim for

innovative practice, for effective collaboration and system

integration, and for sustainable private investment that can promote

inclusiveness, quality and effective response to crisis can therefore

only work if the worst of these perverse market dynamics can be

contained and constrained. In this light, the interactions we sketch

here between market structure and incentives and business behaviour –

we label this interaction ‘market dynamics’ – merit further

policy-oriented research.

Methods

The evidence reported here derives from fieldwork in 1998-9 in

Tanzania. The price data are 1998 and the financial data 1997. Two

distinct urban health care markets were studied plus part of the rural

hinterland of each: a district of Dar es Salaam (the largest city) and

a contiguous district of predominantly rural Coast region; and Mbeya

in the Southern Highlands, a smaller town with sufficient income to

attract support some private providers, and the adjoining district of

Mbeya Rural. Interviewees in 10 hospitals and 36 health centres and

dispensaries included facilities’ staff and patients on exit from

facilities; members of 108 households in the facilities’ catchment

areas were also interviewed.

The facility interviews included discussion of pricing and business

strategy and facility finances. As agreed with respondents, some of

whom were extremely frank, we have somewhat anonymised the financial

data by rounding and simplifying, and in some stated instances by

combining more than one facility’s data to create ‘representative’

accounts. The case studies presented are of non-governmental

facilities: private for-profit ( ‘private’ for simplicitly), and

religious-owned and secular NGO (‘religious/NGO’ or ‘non-profit’).

price competition and market structure in Tanzanian health care

markets

Tanzania relies substantially on non-governmental health care, though

less than some African countries. Just under 40% of registered

dispensaries in Tanzania in 2001 were in the private and non-profit

sectors (URT 2002). The 2001 Household Budget Survey suggested that

about one in five visits to health facilities were to the

non-governmental sectors in all wealth quintiles; furthermore the

urban poor rely particularly heavily on non-governmental primary

providers (Kida and Mackintosh 2005). The Tanzanian Demographic and

Health Survey of 1996 showed that of children taken for treatment for

two common childhood illnesses, over 50% on average were seen by

non-governmental providers, with higher percentages in lower quintiles4.

Two key features of the local market structure in health care in

Tanzania in the late 1990s shaped very strongly the observed business

behaviour of non-governmental facilities. These features were market

segmentation in pricing – that is, the existence of distinct higher

and lower charging segments of the market – and strong price-based

competition for patients in the lower income, lower charging market

segment.

Dar es Salaam city has a high income segment of its population that

supports some high-charging non-government, mostly non-profit

hospitals. These charged very substantially more than the small Mbeya

private hospitals. In primary care however the situation was reversed.

In Dar es Salaam, which has limited government and faith-based primary

provision, many very low income people rely on private primary care,

and prices were correspondingly low. In Mbeya, non-governmental

providers were charging on average more (Mackintosh and Tibandebage

2002).

In each local market, mean and median prices for a bundle of services

supplied by all primary providers did not differ greatly between the

private and non-profit providers, and this was also true of observed

payments by patients on exit from facilities. However, the pattern of

pricing within the private and non-profit sectors was very different.

The private facilities were notably price-conscious, reporting that

they observed and responded to the prices of competitors. The price

data support this qualitative evidence: the spread of private

facilities’ reported prices was narrow as compared to the much wider

spread of prices reported at religious-owned and NGO facilities

(Tibandebage and Mackintosh 2002). (Figure 1 also includes government

primary facilities imposing formal charges).

Figure 1 Dotplot: primary facilities’ reported prices: robust mean of

reported prices for a standard set of services, Tanzanian shillings,

1998

Each local market displayed an emerging pattern of market segmentation

(Figures 2 and 3). Each had a low-charging segment, including some

large facilities all government and religious-owned. Each also had a

more scattered higher charging group of private and non-profit

facilities including several larger facilities. Figures 2 and 3 show,

by region, scatter plots of median observed charges (on exit) against

the robust mean5 of list prices for a standard set of services. The

size of each circle is proportional to the size of facility as

measured by out-patient visits. The observed charges are generally

consistent with list prices except for a few Mbeya observations where

high charges relative to prices suggest informal charging in these

non-profit facilities (Mackintosh and Tibandebage 2004).

Figure 2 Dar es Salaam health centres and dispensaries, median charges

plotted against robust mean of prices, Tanzanian shillings, 1998

Figure 3 Mbeya health centres and dispensaries, median charges plotted

against robust mean of prices, Tanzanian shillings, 1998

Business strategies within market constraints in the Tanzanian health

care markets

Market structure and incentives influence business growth and

behaviour; business responses feed back into changing market

structure, influencing opportunities and constraints. Using case

studies, we examine in this section several key aspects of such

cumulative path-dependent change in the relatively young

non-governmental health care businesses in Tanzania in the late 1990s.

Private clinical practice had been liberalised only in 1991; before

that, only a few religious-owned independent facilities had been

licensed. All the private dispensaries and health centres and two

private hospitals studies had been established between 1993 and 1997;

two Dar es Salaam private hospitals had started earlier than 1991

under a religious ‘umbrella’.

A private dispensary or health centre had by law to be owned by a

medical doctor, though this was not always in fact the case. The

private hospitals studied were all owned by one or more doctors. This

private individual ownership had implications for investment and

innovation analysed below. The religious and other non-profit

facilities varied greatly in effective ownership and control. Some

religious facilities were long established and were experiencing

falling activity as a result of competition from new non-profit and

private providers.

The private facilities tended to be small: the median number of

outpatient visits per year to the private primary facilities was

3,358, and only one had over 10,000 out-patients. No private hospital

studied had over 2000 inpatients. Religious and other NGO facilities

were on average larger, but only one health centre had over 20,000

outpatient visits in the year; two religious-owned hospitals had

between 5000 and 7000. Government facilities were generally larger and

government hospitals very busy especially in Dar es Salaam.

The emptying middle: the consequences of price competition and bad

debt at a Dar es Salaam private health centre

One of the most problematic market dynamics observed was the severe

pressure on credible facilities in the ‘middle’ of the market. These

were facilities seeking to provide quite a wide range of services,

using skilled staff, to a local population with incomes well above the

lowest but well below the very expensive non-profit hospitals and

specialist private clinics in Dar es Salaam.

The market pressures tending to ‘squeeze out’ of the Dar es Salaam

market such reputable providers are illustrated by a case study based

on a single private facility6. The health centre was run by full time

medical personnel, not as was more usual by doctors ‘moonlighting’

from the government sector (Tibandebage et al 2001). Operating in a

medium density residential area, it served a mixture of firms’

employees, paid for by employers, and paying individuals.

The health centre provided curative and preventative care, took

short-stay in-patients, and ran dental and eye clinics. The ownership

was, like many Dar es Salaam facilities, joint between a businessman

and a medical doctor, the businessman having put up funds from the

profits of other businesses. Without such as arrangement, it was

almost impossible for medical doctors to raise capital. The two owners

estimated that they had put Tshs 30 million ($US 43,000 at the then

rate of exchange) of capital investment into the business in less than

five years; their building was rented.

Recurrent running costs were substantial (Table 1). Rounded

expenditure is recorded before depreciation and before owners’

remuneration. The staffing bill includes three clinical officers,

nursing staff and a laboratory assistant; the medical

officer-in-charge, one of the owners, worked there full time. This was

therefore an attempt to build up a substantial business.

Table 1: Activity and recurrent expenditure estimates, main headings,

for a private health centre, Dar es Salaam, 1997

Activity

Numbers

OPD numbers

30,000

In-patient numbers

1,000

Total activity = OPD + (inpatients x3)

33,000

Expenditure

Tanzanian Shillings (Tshs)

$US equivalent

Total recurrent expenditure:

of which:

110,000,000

157,143

Salaries and wages, including NPF*, allowances, and staff medical

treatment

26,000,000

37,143

Drugs and other medical supplies

65,000,000

92,857

Total expenditure/ OPD patient

3,667

5

Salaries and wages/ total activity

788

1

Drugs and supplies bill/ total activity

1,970

3

Recurrent expenditure/ total activity

3,333

5

* National Provident Fund contributions for staff

This facility faced a number of threats to its viability. To cover

recurrent expenditure at these patient numbers it had to charge above

median observed Dar es Salaam charges; profitability required charges

of about US$6 per outpatient. In a country where an estimated 57% of

the population live below the international dollar-a-day poverty line

(URT 2005: 114), these charges are not easily affordable for each

illness episode. One of the owners stated that they had been losing

patients to competing lower-charging dispensaries, and now had perhaps

60% of the activity of their early years.

All recurrent income was from fees and charges. Most patients (about

75%) were paid for by their employers, who were billed monthly;

charges were somewhat higher for employers than for individual

patients, reflecting the fact that employees were treated on credit.

The owners stated that while the facility was viable in 1998 in terms

of the balance between invoiced income and costs, it had severe cash

flow problems because of bad debts. Many company clients did not pay

their bills on time, and the National Insurance Corporation was also a

bad payer to the health centre for patients from companies entered

with it.

The owners employed a number of strategies to keep recurrent costs

down. The doctor owner ran the facility. Staff were well qualified but

numbers were low compared with a Dar es Salaam religious dispensary

studied. From the owners' point of view the salary bill was an

overhead cost that had to be recouped from sale of services and

medicines. Income sharing with part time service providers was also

used to keep down salary costs: for example, an assistant dental

officer worked at the facility using his own equipment and shared the

income 65/35 with the owners.

Facilities such as this faced market pressures to move towards

hospital status and away from primary care because of competition from

low charging dispensaries and drug shops. This competition reduced

income from the sale of medicines – a key element of profit - by

forcing down prices. Furthermore, the doctor owner saw the health

centre as at a market disadvantage because it was paying higher

salaries to qualified personnel while some other local facilities

employed Red Cross or nursing assistants. Given the poor economic

situation and lack of money in individual patients’ hands, and given

that patients generally did not distinguish between the qualifications

of staff in different facilities, individuals tended to go to a

cheapest place first, arriving at the health centre only when

seriously ill.

Hence the owners said that the most profitable areas of activity were

laboratory tests and in-patients, where there was less competition.

Furthermore, employers looked to facilities with which they contracted

to provide a wide range of services. These pressures were pushing the

owners towards trying to raise money to move the facility to hospital

status. These pressures tend to leave basic primary care to the less

well qualified while generating over time surplus in-patient capacity

in the private sector, hence raising costs. We asked one owner

whether, knowing what he does now, he would start the facility now,

and he replied, no; the large sunk investment was clearly at risk.

Financial instability and high turnover in the private sector: two

routes to bankruptcy

The private dispensary sector displayed high rates of turnover,

frequent bankruptcy and repeated closure and reopening (Tibandebage et

al 2001). Most private dispensaries studied were indeed in financial

trouble, and two case studies presented here identify the major

reasons.

The first source of problems was size: many dispensaries were too

small for viability. Table 2 shows the (rounded) accounts of a

dispensary in Mbeya owned and run by an Assistant Medical Officer7 who

could not pay staff because the dispensary could not attract

sufficient numbers of paying patients8.

Table 2: Sources of financial stress: an Mbeya dispensary, income and

expenditure estimates, 1997 (Tshs)

Activity

Numbers

OPD visits

2,500

MCH visits

500

Expenditure and income

Tshs

$US equivalent

Total expenditure:

of which:

5,500,000

7,857

Salaries and wages

2,500,000

3,571

Drugs and medical supplies

2,000,000

2,857

Expenditure/OPD visit

2,200

3

Salaries and wages/OPD visit

1,000

1

Drugs/ OPD visit

800

1

Estimated charged income/ OPD visit

3,000

4

The facility saw only around ten patients a day. Its cash flow was

further undermined by slow-paying company clients, as well debts of

low income individuals unable to pay on the spot and allowed to defer

payment. Many private providers attracted patients by providing such

credit, but then suffered bad debts. In these circumstances, this

facility could use qualified staff only because they were family

members working for less than the market wage. The owner attempted to

find 1000/- ($US1.4) for each person each day. ‘It is very difficult

to pay in full … we divide what we get each day.’ He prioritised

restocking with drugs, knowing that this was what brought in profit.

The qualified staff attracted company clients whose staff were treated

on credit; all paid very slowly. One parastatal had sent around 500

patients over a seven month period, for whom they had not yet paid one

shilling. The dispensary was therefore in a weak negotiating position:

the company was now sending few people, and if the dispensary sent

those away the company would probably never pay. So they went on

treating them, creating a huge hole in their cash flow.

The other outpatients were mainly very low income, so prices also had

to be kept down to the lowest private facilities’ prices found in

Mbeya, The exit interviews support the owner's statements:

interviewees divided between billed clients from a parastatal and

individual patients each of whom had had difficulty paying and were

allowed to defer part of the payment. Patients described the facility

as friendly, cheaper than others (but not cheap), and they

particularly approved of the availability of diagnostic tests.

The income estimate in Table 2 includes payments company clients

should have made. The struggling dispensary owner estimated that to

pay the staff a salary for their work, given some inevitable bad

debts, he needed considerably more patients than he was getting. A

strategy of reducing prices further in order to expand custom was not

working as hoped and had reduced income. There were too many private

facilities chasing too few private patients in Mbeya.

That was also true in Dar es Salaam, and a number of private

dispensaries in both towns were trying much less hard than those just

described to provide a reputable service. The liberalisation of

private clinical practice had drawn a number of businessmen into

investment in dispensaries. As one interviewee put it:

People's decisions to open businesses go in phases here. Once it was

chickens, everyone invested in those; then it was daladalas [minibuses

for public transport], that has stopped now; then it was kiosks, they

were everywhere... now it is groceries and dispensaries.

He was hoping fashions would move on, leaving some dispensaries as

sustainable businesses, but said it was too soon to tell.

A typical and often problematic business structure was for a

businessman to own the dispensary, the licence being held by a doctor

also employed at a government facility who visited the dispensary on a

(sometimes rare) part time basis. The businessman focused on making a

return on investment, and there were repeated reports of purchases of

'cheap' drugs (of dubious quality), of high charges to desperate

patients, and of staff with very low qualifications. One

owner/investor regretted that he had reinvested pharmacy profits in a

dispensary. The overheads he said, including the salary bill, were too

high, 'you need 10 staff to start a dispensary', and he had begun

laying off staff. Competition thus generated market pressure to drive

down quality and created incentives for over-charging.

Bankruptcies were common, and we observed one. This Dar es Salaam

dispensary was clearly struggling when first visited in August 1998,

and closed a month later. The rapidity of the bankruptcy and the money

lost in the final six months illustrate some of the pressures on these

small businesses, not only competition but also vulnerability to loss

of reputation and to (rational) short-termist behaviour on the part of

salaried staff.

The dispensary, in a peri-urban area, was quite long standing, dating

from 1993. Its original owner was a doctor. The building was suitable,

and in the first couple of years the dispensary seems to have done

quite well. Then other facilities opened and the general economic

situation of people worsened. By 1997 the doctor was seeking a

business partner; he persuaded a neighbour in the construction

business to put up some money and become part-owner. By 1998 the

business was being run by a clinical officer, with, it appears, little

involvement of the doctor.

The businessman owner said he lost over Tshs 3 million ($US 4285) in

six months. As he saw it, there were three related problems. First the

staff knew, but he did not, just how shaky the business was. He

thought the business could be turned around, that it just needed some

investment to ensure a good supply of drugs and sufficient staff. The

staff knew they were not getting enough patients.

Second, his management of the facility was poor, indeed he failed to

realise he had to manage it. He tried instead to persuade the staff it

was 'their' business and told them to manage the money, arguing that

they would not otherwise feel it was theirs. He found out later that

before his arrival the 3 prescribing staff had been working part time,

and the nursing staff were only taking about 100,000/- ($143) a month

in salaries. On his arrival they 'inflated' the salaries and

allowances and said they would come back full time; the businessman

still thought the salaries low for doctors, he had no idea of market

rates. They were, he said, 'cheating themselves', but they clearly

thought the business had no future. He saw this as a 'parastatal

mentality' of short term personal gain.

The third problem was a loss of confidence by local people in the

dispensary. A critically ill child was brought to the dispensary and

died an hour later of pneumonia. Reports in the papers implied the

child had been mishandled. 'It was enough to chase people out of the

place'.

The investor took over in January 1998. Monthly recurrent expenditure

- rent, utilities, salaries, drugs - was running at about 750,000/-

($1700) a month, 500,000/- ($714) of that being salaries. Income was a

respectable 650,000/- ($929) a month but that was not covering

expenditure. About 1.5 million shillings ($2143) was spent on

renovation and new equipment.

Prices seem also to have been inflated in early 1998, as at least one

member of staff attempted to increase short-term income. Dispensary

activity and income fell. Meanwhile, the new owner renegotiated

salaries downwards, but by that time income was falling and never

covered expenditure. The child died in March. Figure 4 shows the

downward track. In August the dispensary still had a stock of drugs,

but few patients and few staff. By late September the staff were

selling the remaining drugs on their own account. The owner had gone

into the leisure business.

Figure 4: a Dar es Salaam dispensary: income and expenditure flows

leading towards bankruptcy.

The key role of subsidy: private and non-profit examples

The facilities described so far were operating largely without

subsidy, and all were struggling. Across the private and non-profit

sectors, some primary facilities were doing better and all were being

supported by clearly identifiable subsidy: that is, a source of funds

in addition to charges. We examine here the sources and uses of

subsidy.

The most common source of subsidy to private facilities was

‘moonlighting’: the use of skilled staff trained and employed in the

public or non-profit sectors. Effective use of this subsidy to support

a business is illustrated by an Mbeya private dispensary, located in

quite densely populated area. It was owned by a medical officer

working mainly at a hospital, while his wife, a nurse, managed the

facility: another common ownership and management structure. They

provided primary curative care, ante-natal care, under-5s clinics and

family planning. There were three beds for 12 hour observation, and

the dispensary assisted with normal childbirth. The staff included a

clinical officer, other nursing staff and a laboratory assistant.

The facility derived all its income from fees and charges, used some

of it to support free MCH provision. The nurse saw MCH services in

part as a ‘marketing’ investment: women who came for ante-natal care

might pay to deliver at the facility; they might also return and pay

for curative care for their families. However, MCH required two full

time MCH aides costing the dispensary about 700,000/- (US$1000) a year

that had to be recouped from outpatient charges. Vaccines were

supplied by the municipality.

Most patients were of low and medium income and paid for themselves;

very few were assisted by employers. The wage bill in Table 39 does

not include any payments to the owner and his wife. In addition to the

expenditure shown in the table there were taxes to pay, though the

accounts include the licence fee.

Table 3: Illustrative accounts constructed from data for two Mbeya

private dispensaries, 1997/8 (Tshs)

Activity

Numbers

Activity (OPD visits)

5,000

Activity (MCH visits)

4,000

Expenditure and income

Tshs

$US equivalent

Total current expenditure:

14,000,000

20,000

of which:

Salaries and wages

4,500,000

6,429

Drugs and other medical supplies

6,500,000

9,286

Expenditure/OPD visit

2,800

4

Salaries and wages/ OPD visit

900

1

Drugs/OPD visit

1,300

2

Estimated income/ OPD visit

3,600

5

Estimated gross income for 1997/8 was about 3600/- per outpatient, a

level consistent with the statements of exit patients (recollect that

prices were higher in Mbeya than in Dar es Salaam). Of this, less than

500/- per patient was from fees for registration and consultation;

most of the income came from charges for procedures and drugs.

Profitable areas of activity were thought to be laboratory tests and

drugs, and also assistance with normal childbirth.

The nurse-owner estimated that the facility’s activity levels were

sufficient for profitability over recurrent costs, but she felt that

the financial situation of the dispensary remained precarious. She saw

the dispensary’s strengths as capable staff and owners with good

reputations. The main weakness was the lack of a medical officer

present at the facility. The doctor-owner could not afford to spend

much time there. Their plans included trying to expand their

diagnostic facilities, and to do simple minor surgery (that is, again,

to go up-market); they also aimed to expand post-natal care free of

charge to bring more people into the facility. This was a viable local

dispensary, and was cross-subsidising public health activity from

fee-income, but it would need much higher activity before it could pay

a medical officer for a substantial element of his or her time.

In adapting to private competition, the non-profit facilities all

relied on donations for survival. Their access to donations, plus

religious facilities’ reputation for good practice (not by any means

always deserved), formed their competitive advantages against the

private sector. By using subsidy to sustain decent quality and to keep

prices accessible, some religious facilities were maintaining patient

numbers or expanding against the wider trend. Table 4 shows two

distinct but comparable cases: a Christian dispensary in rural Mbeya

region and a Muslim dispensary in Dar es Salaam. Both also used

donations to support some charitable exemptions from fees. Both

operated in low income areas, and were large for their area, providing

outpatient and MCH services. The financial data have been rounded and

summarised, but represent quite closely the financial situation of the

dispensaries as explained to us.

Table 4: Two faith-based dispensaries, 1997

Mbeya

Dar es Salaam

Activity

Number

Number

OPD visits

18,000

50,000

MCH visits

35,000

not available

Income and

expenditure

Tshs

$US

Tshs

$US

Fee income

15,000,000

21,429

165,000,000

235,714

Total expenditure :

17,000,000*

24,286

160,000,000**

228,571

Salaries and wages

4,000,000***

5,714

58,000,000

82,857

Drugs, medical sup. Supplies

9,000,000*

12,857

82,000,000**

117,143

Expenditure/ OPD visit

944*

1

3,200**

5

Salaries/ OPD visit

222***

0

1,160

2

Drugs /OPD visit

500*

1

1,640**

2

Fee income/ OPD visit

833

1

3,300

5

Notes * includes expenditure of donated supplies, services and funds

** does not include expenditure of donated inputs in kind

*** not including an externally paid salary

The Mbeya clinic kept prices very low by modest staffing levels and

through subsidy. Initially an MCH clinic, the facility had expanded

into outpatients. It was run by an expatriate sister who was a

nurse-midwife and a clinical officer, supervised by a part time

medical officer, plus nursing staff and a laboratory assistant.

Consultation charges included drugs: no patient had been sent away

with a prescription to purchase drugs elsewhere. The sister in charge

was a successful fund-raiser: over half of drugs and medical supplies

and most of the office supplies were supported by overseas donations.

The local religious organisation also supported the dispensary,

providing premises, vehicles and salary for the sister in charge. The

dispensary was very busy, with a high MCH workload; when new

facilities opened locally their numbers had fallen but by 1998 they

were rising again. The low prices were unsustainable without

donations.

In the Dar es Salaam dispensary much of the original investment had

been financed by donations, both local and (particularly) overseas, to

a total of about Tshs 22.5 million ($US 32,000). The dispensary

continued to receive donations and local subsidy, mainly in kind, in

the form of drugs, equipment such as a pressure machine and beds, and

rent free premises. The dispensary was very busy, and numbers had

increased 15% over the previous year. In addition to general OPD

services, the dispensary had MCH clinics and clinics for dental care

and for managing chronic complaints such as cardiac problems and

hypertension. It also provided acupuncture.

This dispensary charged substantially more than the Mbeya dispensary.

The higher running costs and income per patient shown in Table 4 also

reflect a higher level of staffing (including three medical officers

with MO or AMO training) and a larger range of services. The

remuneration of doctors and nurses included a proportion of the

consultation and procedure fees (but not prescribing charges; there

appeared to be no incentive in the payment structure to

over-prescribe). The dispensary was reinvesting in expansion. It also

maintained a charitable account to assist people who were elderly or

destitute, some recommended by religious leaders. The dispensary was

overseen by a Board of Trustees who, among other things, approved all

major purchases and set the facility's prices.

These were two cases where subsidy was being used for broad public

benefit. A number of other religious facilities behaved differently,

aiming to charge more and to serve the better off: these were trading

on the reputation of religious facilities for good quality in order to

raise prices. The case in Table 5 is representative of several,

Christian and Muslim. Income came 80% from drugs sales, and prices for

primary care were the highest in the Mbeya study; furthermore the

internal accounting system gave clinical officers an incentive and

opportunity to over-prescribe and over-charge. The facility received

substantial donations but was covering running costs from fee income:

donations did not subsidise fees. It was well staffed, with a full

time medical officer and nursing staff and had a small laboratory.

However activity was falling, in part because charges were as high as

local private hospitals.

Table 5: A higher-charging religious facility in Mbeya

Activity

Number

OPD visits

15,000

Income and expenditure

Tshs

$US

Fee income

60,000,000

85,714

Total operating expenditure, of which:

56,000,000

80,000

Salaries and wages

17,000,000

24,286

Drugs and medical supplies

21,500,000

30,714

Operating surplus

4,000,000

5,714

Expenditure/ OPD visit

3,733

5

Salaries/ OPD visit

1,133

2

Drugs /OPD visit

1,433

2

Income/ OPD visit

4,000

6

Binding constraints and their consequences

We have identified price competition and small size as key constraints

and sources of bankruptcy and poor quality. Other financial

constraints included difficulties in accessing capital and problems of

managerial control. Private facilities not financed from other

businesses faced severe problems of working and investment capital.

The financial constraint on scaling-up was exacerbated by problems of

trust and control. This interaction can be illustrated by a small

private hospital in Mbeya, owned and run full time by a specialist

doctor and surgeon. When visited, it was half constructed: funds were

being ploughed back as earned, building the hospital gradually using

many local materials including timber from family land. The doctor

also owned the building, so he could obtain some bank loans for

building materials, but this was very costly. The hospital had pit

latrines and water delivered by tanker when we saw it first, and had

improved on our return a year later.

The most profitable areas of activity were, the owner said, surgery

and sale of drugs, and the hospital was covering its costs. Premises

for government-run TB and leprosy clinics were provided free of

charge: these he said were "raising the profile of the hospital".

However there were problems of financial control. Family members were

cashiers and managed sales, drugs procurement and stores; a relative

had however embezzled funds. The owner was therefore doing his own

accounts, audited by an outside accountant, and was eloquent about the

difficulty of finding an administrator he could trust. Discussing the

difficulties of such single handed management by a sole doctor, the

owner said that it was difficult for professional partnerships to work

between doctors for business purposes in Tanzania. Instead, to expand

turnover and keep staff costs down, he too engaged in revenue-sharing

and rental arrangements: letting out the theatre to other surgeons and

sharing revenue with them and with a part time dental assistant. This

very personal business structure was a major constraint on stability

and growth.

Among non-profit facilities, a lack of subsidy was observed to be

lethal. A small but long standing religious dispensary in Dar es

Salaam illustrated a typical pattern. A loss of support from overseas

had forced the facility to increase prices in the 1980s, leading to

complaints from patients and falling activity that worsened when

competition increased in the 1990s. In response they cut prices, which

reduced revenue further, making it impossible to fund the staffing to

resume MCH services. An attempt to introduce prepayment insurance

based in the religious organisation had attracted insufficient numbers

and the facility was on the verge of closure.

A deregulated and scale-constrained health care market: implications

for innovation, quality and ACCESS TO CARE

We now draw together the lessons from these cases. This is a

deregulated health market dominated by small precarious businesses: a

fragmented mini-entrepreneurship also familiar in other Tanzanian

productive sectors10. Can such a sector achieve sustained improvements

in health care? Can it provide an environment for policy within which

it is possible to encourage innovation in health delivery to the poor,

including higher quality, better access and lower impact of illness on

impoverishment? The evidence presented above identifies a number of

key problems.

First, good primary health care needs to be routinely available,

physically and financially accessible, reliable and stable; it also

needs to be trusted in terms of basic quality indicators such as

cleanliness and use of reputable medicines and trained staff, and to

do effective preventative care. However, there were no market

incentives driving this health system in this direction. Rather, the

dominant market incentives tended to shift the non-governmental

facilities away from these objectives. The competitive pressures to

attract sufficient patients with very low incomes were tending to

drive private and non-government facilities in two directions, both

problematic: towards lower priced/ lower quality care, or towards

higher priced, more complex and more exclusionary provision. We called

this trend the ‘emptying middle’.

This trend implies, second, that only non-governmental facilities that

aim to resist these dominant market incentives, and that do so

successfully, can build up the needed primary care. Such facilities

existed, as we have shown, in both private and non-profit sectors.

Their preconditions for survival appeared to be professional

commitment (that may be reinforced by religious principles) and a

source of financial subsidy in addition to fee income. Commitment

alone is insufficient. The decent, viable and reasonably accessible

private dispensaries were supported by medical staff salaries earned

elsewhere; the ‘charitable’ religious facilities by donations.

Third, the non-governmental facilities were very financially

constrained. Many were simply not financially viable, and those that

survived relied systematically on resources from outside the business.

They displayed many of the characteristic problems of small business

in other sectors, cumulated by characteristic health market problems.

Overheads and risk are both high, asset ownership low and formal loan

finance rare. Investment funds came from donations (religious

facilities), businesses in other sectors (most private facilities),

and internally generated revenues. All three sources posed problems.

Donations could be fickle and had strings attached; businessmen looked

for short term returns; the internally generated revenues were sparse

and required a move up-market that raised costs or were sustained by

lowering quality. Investment funds to raise quality or innovate were

very hard to find.

Fourth, the organisational constraints on business development and

innovation were also severe. They include problems of hiring and

motivating staff who may take a ‘short-termist’ view of their

prospects in small precarious businesses. Informalisation in

non-governmental facilities included informal charging by staff above

listed prices and the pocketing of revenues: these are not just

government sector problems. Facility owners responded by keeping the

staffing in the family, which reduced costs but constrained growth.

Family members may be paid less or not at all: another ‘informal’

business characteristic unlikely to improve staff motivation over time

and observed to be associated with lack of control. Successful

facilities expended a good deal of effort on motivating staff, and

this might include benefits in kind such as housing: another item

dependent on subsidy or financial viability. There were few

information sharing-processes, for professional development or patient

management, even among facilities owned by the same religious

denomination. Creating larger, more formal businesses, or networks of

facilities, in these conditions is very difficult indeed.

Conclusion: a major policy challenge

The market and business structure just examined creates a hugely

challenging environment for health system strengthening and

innovation. If a ‘health system’ is defined as an integrated set of

organisations and processes with an objective of population health

improvement (Mackintosh and Koivusalo 2005b), this market does not

qualify. Larger scale operation, stability, accessibility, decent

return on investment and reliable quality are essential to delivering

comprehensive and effective primary care; yet the incentives here were

for high turnover, segmentation, the loss of innovations such as free

private MCH provision, and declining quality for the poor majority.

The market dynamics were creating pressure for under-used provision at

the higher end of the market, within unstable private businesses and

subsidised non-profit facilities, side by side with an acute

insufficiency of basic, accessible, quality-assured primary care.

To do better requires learning from those businesses that were

managing to combine commitment to standards with good use of subsidy,

in both private and non-profit sectors. Subsidies to the

non-governmental sectors are rising, some expressly directed at

innovation, including public/private partnerships, private sector

support programmes, and experiments in social marketing and social

franchising. Support for good quality non-governmental provision will

however face constant undermining from the perverse market incentives,

driven by extreme poverty, analysed above.

It follows that policy advisers and policy makers seeking to expand

the role of private provision in these conditions will have to find

ways to change the market incentives. A number of tentative

conclusions can be drawn about how that might be done. First, a way

needs to found to put a ‘floor’ under quality deterioration while

sustaining access by the very poor: highly subsidised, low price or

free, governmental and non-profit provision potentially could ‘compete

out’ the worst quality private providers, especially if associated

with more effective punitive regulation of illegal provision. Second,

effective non-governmental providers need support if they resist the

perverse market incentives. Governments and donors will have to move

away from the regulatory model of the ‘level playing field’ towards

selective support of successful and innovative provision (Mackintosh

and Tibandebage 2002).

This might imply subsidising networks of closely regulated low-priced

non-governmental facilities with the deliberate intention of

undercutting poor quality and abusive private provision. Active support

for health system integration and organisational sustainability and

probity is essential for poverty-focused care and innovation, and will

require major investment and deliberate structural change after many

years of deregulation and fee-based finance. Policy should aim to

constrain perverse market dynamics and move towards system

integration. Whether or not this implies a move away from

fee-for-service payment in primary care is currently a focus of active

debate in Tanzania and many other African countries.

References

Asiimwe, D. (2003) ‘Private health care in Uganda – the poverty cycle

explained’ in Söderlund et al (2003)

Bennett, S. McPake B, and Mills A. (Eds.) (1997) Private Health

Providers in Developing Countries: Serving the Public Interest? Zed

Books. London.

Bennett, S. Hansen, K. Kadama P and D.Montague (2005) ‘Working with

the non-state sectors to achieve public health goals’ Making Health

Systems Work Working Paper 2, WHO Geneva www.who.int/management

accessed 18 September 2006

Bloom, G. (2004) Private Provision in its Institutional Context:

Lessons from Health DFID Health Systems Resource Centre

www.dfid.gov.uk accessed 5 November 2005

Bloom, G. and Standing H. (2001) ‘Pluralism and marketisitation in the

health sector: meeting health needs in contexts of social change in

low and middle-income countries’, IDS Working Paper 136, Institute of

Development Studies, Brighton, Sussex.

Freedman, L. Waldman R.J., de Pinho, H. Wirth, M.E., Mushtaque A

Chowdury R. Rosenfield A. (2005) Who’s Got the Power? Transforming

Health Systems for Women and Children UN Millennium Project, Task

Force on Child Health and Maternal Health, Earthscan, London

Janovsky, K and D. Peters (2006) ‘Improving health services and

strengthening health systems: adopting and implementing innovative

strategies’ Making Health Systems Work Working Paper 5, WHO Geneva

www.who.int/management accessed 18 September 2006

Kida, T.M. and Mackintosh, M. ‘Public expenditure and incidence under

health care market reforms: a Tanzanian case study’ in Mackintosh and

Koivusalo (2005a)

Leonard D. K. (Ed.) (2000) Africa’s Changing Markets for Human and

Animal Health Services Macmillan, London

Mackintosh M. and M. Koivusalo (eds.) (2005a) Commercialization of

Health Care: Global and Local Dynamics and Policy Responses

Basingstoke, Palgrave Mackintosh M. and M. Koivusalo (2005b) ‘Health

systems and commercialization: in search of good sense’ in Mackintosh

and Koivusalo (2005a)

Mackintosh, M. and Tibandebage, P. (2004) ‘Inequality and

redistribution in health care: analytical issues for developmental

social policy’ in Mkandawire, T. (ed.) (2004) Social Policy in a

Development Context Basingstoke, Palgrave

Mackintosh, M. and Tibandebage, P. (2002) ‘Inclusion by design:

rethinking health care market regulation in the Tanzanian context’

Journal of Development Studies 39 (1), 1-20

Mensah, K. Mackintosh M and L. Henry (2005) The “Skills Drain” of

Health Professionals from the Developing World: a Framework for Policy

Formulation London, Medact http://www.medact.org

Mujinja, P. Mpembeni, R. and S. Lake (2003) ‘Regulating private drug

outlets in Dar es Salaam – perceptions of key stakeholders’ in

Söderlund et al (2003)

Pearson M. (2004) ‘Economic and financial aspects of the global health

partnerships’ DFID Health Resource Centre GHP Study paper 2 London

DFID www.dfid.gov.uk accessed online 5 November 2005

Save the Children (2005) The Unbearable Cost of Illness Save the

Children, London

Söderlund, N., Mendoza-Arana, P. and J. Goudge (2003) (Eds.) The new

public/ private mix in health: exploring the changing landscape

Alliance for Health Policy and Systems Research, Geneva

Tibandebage, P. , Semboja, H., Mujinja, P. and Ngonyani, H. (2001)

‘Private sector development: the case of private health facilities’

ESRF Discussion Paper Series, Dar es Salaam

Tibandebage, P. and Mackintosh, M. (2005) ‘The market shaping of

charges, trust and abuse: heath care transactions in Tanzania’ Social

Science and Medicine 71: 1385-1395

Tibandebage, P. and Mackintosh, M. (2002) ‘Institutional reform and

regulatory relationships in a liberalising health care system: a

Tanzanian case study’ in Heyer, J., Thorp, R. & Stewart F. (eds.)

(2002) Group Behaviour and Development: Is the Market Destroying

Cooperation? (271-289) Oxford, Oxford University Press

United Republic of Tanzania (URT) (2005) Research and Analysis Working

Group Poverty and Human Development Report 2005, Mkuki na Nyota

Publishers, Dar es Salaam

United Republic of Tanzania (URT) (2002) Health Statistics Abstract

Vol. II Inventory Statistics Ministry of Health, Dar es Salaam

World Bank (2003) World Development Report 2004 Making Services Work

for Poor People Washington, World Bank

World Health Organisation (WHO) (2004 The World Health Report 2004

Geneva, WHO

1 The IFC announced in September 2006 a $2.6 million programme, funded

by the Bill and Melinda Gates Foundation, to explore private

investment opportunities in African health care, citing the size of

the market and the need for private sector improvement to meet

Millennium Goals (Guardian 13.09.06 Dar es Salaam) www.ifc.org

accessed 25 September 2006.

2 WHO country estimates 2003/4 www.who.int/whosis accessed August 2006

3 This generalisation is supported by early findings of current

research in Dar es Salaam by Tausi Mbaga Kida.

4 Demographic and Health Survey for Tanzania, accessed online at

www.worldbank.org March 2005.

5 Robust mean = (twice the median plus the two quartiles)/4

6 Detail disguised for anonymity within this small business world

7 Three years of medical training

8 We are particularly grateful to the owner of this dispensary, since

the financial difficulties were very personally painful.

9 The accounts are constructed – for the purpose of confidentiality –

from accounts of two rather similar dispensaries studied; the data are

rounded, but represent well the financial situation in each case.

10 For example in agriculture (URT 2005 Chapter 3)

24

EJDR TibaMack Final 19.11.06

ASSEMBLEA DE COORDINADORA D’ESCOLES BRESSOL DE CATALUNYA 25 DE

ASSEMBLEA DE COORDINADORA D’ESCOLES BRESSOL DE CATALUNYA 25 DE ACTA DE HECHOS EL H AYUNTAMIENTO

ACTA DE HECHOS EL H AYUNTAMIENTO ESTOS SON EL NÚMERO DE ALUMNOS PROCEDENTES DE YECLA

ESTOS SON EL NÚMERO DE ALUMNOS PROCEDENTES DE YECLA POPULATION (WITH PERMISSION TAKEN FROM CHAPTER 16 HUMAN POPULATION

POPULATION (WITH PERMISSION TAKEN FROM CHAPTER 16 HUMAN POPULATION KÉRELEM RENDKÍVÜLI TELEPÜLÉSI TÁMOGATÁSHOZ TARTÓZKODÁSI CÍM ……………………………………………………………………………………………………………… TELEFONSZÁM …

KÉRELEM RENDKÍVÜLI TELEPÜLÉSI TÁMOGATÁSHOZ TARTÓZKODÁSI CÍM ……………………………………………………………………………………………………………… TELEFONSZÁM … 3 RESOLUCIONES 0 DE JUNIO DE 2011 E31 RESOLUCION

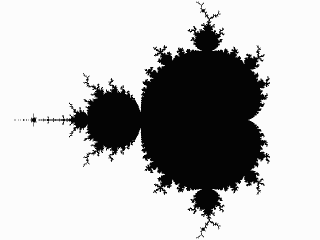

3 RESOLUCIONES 0 DE JUNIO DE 2011 E31 RESOLUCION INTERNET HTTPEGGBAFCZFRACTALSHTML HTTPWWWELEKTROREVUECZCLANKY0102201HTMISO88591 MANDELBROTOVA MNOŽINA (ANGLICKY NAZÝVANÁ MANDELBROT SET

INTERNET HTTPEGGBAFCZFRACTALSHTML HTTPWWWELEKTROREVUECZCLANKY0102201HTMISO88591 MANDELBROTOVA MNOŽINA (ANGLICKY NAZÝVANÁ MANDELBROT SET K EMENTERIAN RISET TEKNOLOGI DAN PENDIDIKAN TINGGI UNIVERSITAS SEBELAS

K EMENTERIAN RISET TEKNOLOGI DAN PENDIDIKAN TINGGI UNIVERSITAS SEBELAS 0 NATV021 97TH PLENARY SESSION 810 OCTOBER

0 NATV021 97TH PLENARY SESSION 810 OCTOBER