overview of federal securities laws by thomas lee hazen june 2007 1. securities transactions are subject to regulation under both

Overview of Federal Securities Laws

By Thomas Lee Hazen

June 2007

1. Securities transactions are subject to regulation under both

federal and state law. Since the federal securities laws are based on

Congress' power to regulate interstate commerce, they generally apply

only to transactions involving "the use of any means or instruments of

transportation or communication in interstate commerce or of the

mails." The courts have been willing to find the requisite use of

interstate commerce facilities in doubtful situations. Use of the

mails to accomplish any part of the transaction, including payment or

confirmation after a sale, is sufficient to support federal

jurisdiction. See, e.g., Franklin v. Levy, 551 F.2d 521 (2d Cir.

1977). An intrastate telephone call has also been held to involve the

use of interstate facilities. See, e.g., Dupuy v. Dupuy, 511 F. 2d 641

(5th Cir. 1975).

2. Federal securities law is based upon six statutes enacted between

1933 and 1940, and periodically amended in the intervening years, one

statute enacted in 1970, and one enacted in 2002. Those statutes are:

a. The Securities Act of 1933 (15 U.S.C. §§ 77a et seq.)

b. The Securities Exchange Act of 1934 (15 U.S.C. §§ 78a et seq.)

c. The Public Utility Holding Company Act of 1935 (15 U.S.C. §§ 79 et

seq.), repealed in 2005

d. The Trust Indenture Act of 1939 (15 U.S.C. §§ 77aaa et seq.)

e. The Investment Company Act of 1940 (15 U.S.C. §§ 80a-1 et seq.)

f. The Investment Advisers Act of 1940 (15 U.S.C. §§ 80b-1 et seq.)

g. The Securities Investor Protection Act of 1970 (15 U.S.C. §§ 78aaa

et seq.)

h. Sarbanes-Oxley Act of 2002 (various provisions of 15 U.S.C. and

other titles of the U.S. Code)

3. The Securities Act of 1933 regulates public offerings of

securities. The Securities Act of 1933, sometimes referred to as "the

truth in securities act," prohibits offers and sales of securities

which are not registered with the Securities and Exchange Commission

(SEC), subject to exemptions for enumerated kinds of securities and

transactions. It also prohibits fraudulent or deceptive practices in

any offer or sale of securities.

4. The Securities Exchange Act of 1934 extended federal regulation to

trading in securities which are already issued and outstanding. Unlike

the Securities Act of 1933, which focuses on a single regulatory

provision relating to the distribution of new issues and other public

offerings of securities, the Securities Exchange Act of 1934 contains

a number of distinct groups of provisions, aimed at different

participants in the securities trading process. The Securities

Exchange Act of 1934 established the Securities and Exchange

Commission and transferred to it the responsibility for administration

of the Securities Act of 1933 (which had originally been assigned to

the Federal Trade Commission). Other provisions of the Securities

Exchange Act:

a. impose disclosure and other requirements on publicly-held

corporations; prohibit various "manipulative or deceptive devices or

contrivances" in connection with the purchase or sale of securities,

b. restrict the amount of credit that may be extended for the purchase

of securities,

c. require brokers and dealers to register with the SEC and regulate

their activities;

d. and provide for SEC registration and supervision of national

securities exchanges and associations, clearing agencies, transfer

agents, and securities information processors.

5. The Public Utility Holding Company Act of 1935 was enacted to

correct abuses disclosed in Congressional inquiries, in the financing

and operation of electric and gas public utility holding company

systems, and to achieve physical integration and corporate

simplification of those systems. The SEC's functions under the Public

Utility Holding Company Act PUHCA) were substantially completed by the

1950's, and the Act accounted for a very small part of the

Commission's work. In 1995, the SEC recommended to Congress that the

Act be repealed, and that the SEC's functions under the Act be

transferred to the Federal Energy Regulatory Commission (FERC). After

many years and numerous calls for the Act's repeal, the Public Utility

Holding Company Act was repealed in 2005. The regulatory functions

that survived PUHCA's repeal were transferred to FERC.

6. The Trust Indenture Act of 1939 applies generally to public issues

of debt securities in excess of a specified amount, which the SEC has

fixed at $ 10 million. See Trust Indenture Act Rule 4a-3. Even though

the issuance of the debt securities are registered under the

Securities Act of 1933, the indenture covering the securities must

also be qualified under the 1939 Act, which imposes standards of

independence and responsibility on the indenture trustee and requires

other provisions to be included in the indenture for the protection of

the security holders. In 1990, the Trust Indenture Act was amended to

simplify the process of preparing indentures and set new

conflict-of-interest standards for indenture trustees.

7. The Investment Company Act of 1940 gives the SEC regulatory

authority over publicly owned companies, which are engaged primarily

in the business of investing and trading in securities. The Act

regulates the composition of the management of investment companies,

their capital structure, approval of their advisory contracts and

changes in investment policy, and requires SEC approval for any

transactions by such companies with directors, officers or affiliates.

It was amended in 1970 to impose additional controls on management

compensation and sales charges. The Investment Company Act provides a

potential trap for companies with a shortage of operating assets in

comparison to their passive investments.

a. Inadvertent Investment Companies. Companies not intending to be

investment companies have been found to be inadvertent companies. This

can happen for example when a company sells a substantial part of its

operating assets and then puts the proceeds into investment securities

while it is searching for other assets or companies to acquire.

Recently this has begun to be a problem for Internet companies that

have raised substantial capital but have few hard assets and most of

their assets in liquid investments (i.e. securities). The problem of

inadvertent investment companies has gained new significance with the

large number of Internet and other high-tech offerings for start-up

companies that initially invest most of their capital.

8. The Investment Advisers Act of 1940, as amended in 1960,

establishes a scheme of registration and regulation of investment

advisers comparable to that contained in the Securities Exchange Act

of 1934 with respect to broker-dealers. Investment Adviser regulation

under the 1940 Act is not as comprehensive as broker-dealer regulation

under the 1934 Act.

9. The Securities Investor Protection Act of 1970 established the

Securities Investor Protection Corporation (SIPC), which has power to

supervise the liquidation of securities firms which get into financial

difficulties and to arrange for the payment of claims asserted by

their customers.

10. The Sarbanes-Oxley Act of 2002 was the Congressional reaction

(overreaction?) to scandals such as Enron and WorldCom. Sarbanes-Oxley

("SOX") brought in various corporate governance reforms, new rules for

auditors, enhanced reporting requirements, increased criminalization,

and new rules of lawyer conduct. SOX amended many provisions of the

1933 and 1934 Acts as well as adopting some standalone provisions.

JUDUL TIDAK LEBIH DARI 13 KATA DAN MENGGUNAKAN HURUF

JUDUL TIDAK LEBIH DARI 13 KATA DAN MENGGUNAKAN HURUF AĞRI İL AMBULANS SERVİSİ İLAÇ HATALARI VE İSTENMEYEN REAKSİYON

AĞRI İL AMBULANS SERVİSİ İLAÇ HATALARI VE İSTENMEYEN REAKSİYON LE PERFECTIONNEMENT PROFESSIONNEL DES ENSEIGNANTS LE NOUVEAU SCÉNARIO ITALIEN

LE PERFECTIONNEMENT PROFESSIONNEL DES ENSEIGNANTS LE NOUVEAU SCÉNARIO ITALIEN CUESTIONARIO PARA LA REVISIÓN DE LAS CUENTAS ANUALES 5ª

CUESTIONARIO PARA LA REVISIÓN DE LAS CUENTAS ANUALES 5ª PRAVILNIK O USLOVIMA I MERAMA ZA HUMANO HVATANJE I

PRAVILNIK O USLOVIMA I MERAMA ZA HUMANO HVATANJE I PROGRAMAS DE MUSICA DE VERANO 2021 LOS CAMPAMENTOS

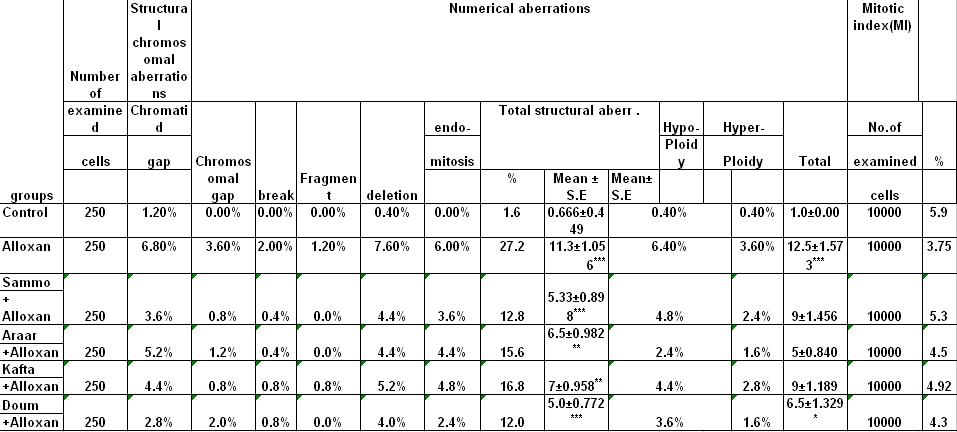

PROGRAMAS DE MUSICA DE VERANO 2021 LOS CAMPAMENTOS CHROMOSOMAL ABERRATIONS IN THE BONE MARROW OF FEMALE RATS

CHROMOSOMAL ABERRATIONS IN THE BONE MARROW OF FEMALE RATS P ŘIHLÁŠKA DO DOMOVA MLÁDEŽE ADRESA STŘEDNÍ ŠKOLA

P ŘIHLÁŠKA DO DOMOVA MLÁDEŽE ADRESA STŘEDNÍ ŠKOLA