2nd gas tariffs fg expert group meeting 4 may 2012 10:30 to 16:00; [creg premises – brussels] final minutes as approved on 30th of

2nd Gas Tariffs FG Expert Group Meeting

4 May 2012 10:30 to 16:00; [CREG premises – Brussels]

Final MINUTES as approved on 30th of May 2012; any substantial

comments to be annexed for publication

(Chatham house rules, no names basis in quotes)

Regulators,

European Commission

Tanja

Held

EC

Benoit

Esnault

CRE

Chair ACER TF

Tom

Maes

Belgium (CREG)

Chair ACER TF

Kerstin

Wernig

Austria (E-Control)

Chair ACER TF

Thomas

Querrioux

ACER

Jan-Peter

Sasse

Germany (BNetzA)

Richard

Miller

United Kingdom (Ofgem)

Edward

Droste

Netherlands (NMa)

Kirsten

Bouwens

Netherlands (NMa)

Experts

Geoffroy

ANGER

GRTgaz

Alex

BARNES

Gazprom Marketing & Trading

Laurent

DE WOLF

Fluxys

Ivan

GHIOSSO

EDF

Debra

HAWKIN

National Grid

Dirk Jan

MEUZELAAR

VEMW, IFIEC

Agatha

PEPTEA

E.ON Energie Romania

Konstantin

PETROV

KEMA

Ralf

PRESSE

RWE

Jorge

ROMAGOSA

Gas Natural Fenosa

Observers/Academic Expert(s)

Johannes

Heidelberger

ENTSO-G

Ann-Marie

Colbert

ENTSO-G

Sergio

Ascari

FSR; Academic expert

NB: in addition to the minutes 8 slide-packs were submitted, of which

only Ascari and Petrov agreed to publication. Other slides are for

internal use by ACER only. The minutes are structured to logically

reflect discussion, not the exact timed order of the meeting.

General remarks.

During the meeting it was discussed that:

*

It is key to capture trade-offs

*

One must check if tariffs are sufficient to get allowed revenue

*

The role of tariffs in incentivizing the use of capacity (think of

CMP-measures)

1.

Problem Identification paper

The general feedback is overall positive. Four themes for enhancement

were discussed:

*

The promotion of short term versus long term products;

*

The differentiation between congested and non-congested

situations;

*

Revenue related issues

*

Transparency

a.

Short term versus Long term

Discussion

The text assumes that producing countries would favor a short term,

cost based approach to tarification. However, in practice, even in

producing countries, long term involvement is promoted to avoid

stranded assets.

The key issue here is to assure that TSOs get revenues, and that (e.g.

tariff) signals ensure a cost-effective use of the system. It means,

for the short term, one needs to assess network operation in relation

to congestion management. For the long term, it means to facilitate

new investments.

Specific remarks on the text

*

On section 2.2: reference to the tariff-related provisions in

balancing should be considered to be included;

*

On section 2.3: the concepts behind dynamic and static

efficiency should be considered to be made explicit;

*

1 of the co-chairs’ answer: these concepts might be too

theoretical. They could be removed from the paper.

*

On section 4.0: it is unclear why producing countries could

prefer the short term approach;

*

1of the co-chairs’ answer: in a producing country security

of supply is less at stake.

b.

Congestion versus non congestion

Discussion

More than a distinction between producing and consuming countries as

the reason for certain approach to tariffs, it is suggested that

scarcity is the relevant driver. Thus, problem identification should

develop on congested versus non congested situations

The distinction between the two situations has been made in CMP. When

UIOLI is put into action, there is a first signal. Then ACER

monitoring report reveals longer term congestions, over 3 years.

However, this distinction has its limits: it is noted that auctions

reveal congestion, but can’t trigger investment. The CMP approach

doesn’t fully take into account the lead time of the necessary

investments to solve an identified congestion.

On the other side, it was argued that distinguishing between the two

situations (“congested” and “uncongested” IPs) would add unnecessary

complexity (considering also the positive effects of Security of

Supply requirements on congestion situation). The congestion

situations could become less common in Europe (thanks to N-1 rule),

except some IP-bottlenecks hampering intraday transfers of

flexibility.

c.

Revenue

Discussion

The problem is as follows:

*

Will under and over recoveries remain a national issue or become a

cross-border issue?

*

Should the revenue be secured ex ante or should ex post resolution

be allowed?

The facilitation of investment, including upstream and downstream

investments, is to be considered. It is a matter of balance: large and

unpredictable fluctuations should be avoided (example: Statoil – UK

issues). Commodity charge can cause such instability. The tariffs

should be reasonably stable and clear to allow investments by upstream

(producers) and downstream (industrial consumers) (2 experts).

On a purpose of stability, one expert acknowledges that an ex-post

mechanism (regulatory account or commodity charge) is necessary to

guaranty the cost recovery of the TSO, but states that this ex-post

mechanism should only take into account unpredictable variations.

One expert states that tariff has to create a relevant economic signal

for domestic transmission and for transit. 1 Observer raises the

problem of a country with an important amount of transit which

decreases. In this case, should the domestic consumer offset the

shortfall?

One expert stresses that some domestic users are condemned to their

capacity. It is a fact that End-consumers cannot choose the TSO, but

upstream competition could lower the end price of End-consumers.

The issue of cost-recovery can be conflicting with non-discrimination.

Importance of a trade-off between LRMC and actual/average price is

identified. It seems that LRMC would in any case need to take into

account cost-recovery.

Given that capacity costs as opposed to variable /operational costs

are driven by location, a locational capacity charge is more ‘cost

reflective’. Therefore any methodology should allow for locational

signals.

Specific remarks on the text

*

On section 2.3, second paragraph : “due to the intrinsic

uncertainty on short term auction revenues” – when capacity is

plentiful, there is no uncertainty;

*

Same sentence: the full transportation charge should be taken

into account and not only the commodity charge;

*

4.2: use of “additional capacity” with a different meaning than

in CAM and CMP;

*

General remark: most of the notions that are discussed are based

on a revenue cap. How can these notions apply to price-cap

regimes?

d.

Transparency

Discussion

Transparency in tariff (not simplicity) is fundamental for the

promotion of investments. Policy options that are clear and

transparent (not necessarily simple) will enable decision making by

stakeholders which should drive down total costs. It should allow

system users to understand how and why tariffs are changing, when they

are changing. It should allow them to make their own predictions.

It is underlined by 3 experts that harmonisation will create a

transition state in regulation that will cause an increase in

uncertainty. Hence, transparency is all the more fundamental.

Specific remarks on the text

*

Creation of a section 4.5 focusing on transparency and

stability.

2.

Questions on Tariff (homework)

*

4 presentations were made explicitly, rest was discussed.

*

Presentations focused on economic fundamentals; tariff context;

example of Romanian-Hungarian issues. Some remark:

*

Tariffs can be set to recover costs that range between

incremental-based and stand-alone based value; regarding

short-term versus long-term pricing: there might not be a solution

to price differentiation of the two products. A suggested approach

could be to monitor the level of revenue recovery based on (longer

terms, earlier booked) capacity reservation: if a certain

threshold is achieved (e.g. 90% of required revenue) shorter term

capacity purchases could be based on auctions with a reduced

reserve price (e.g. the short term marginal cost only).

*

Discussion – 1 expert notes that Tariff actions at domestic level

can create distortions between domestic points and nearby

Interconnection Points. However, as two distinct envelopes

(National and Cross-border IPs) are predefined, it shouldn’t be an

issue. The question is how to make sure that the envelopes are of

the right size. Another remark is that as well as deciding on the

proper balance between short term and long term, there is a need

for a mechanism to cover variable costs.

*

Romanian case study

*

a less liquid market

*

one interconnector, with Hungary;

*

accounts for less than 10% of the consumption of the country.

*

Problems with products compatibility (LT on Hungary side, ST on

Romanian side)

*

In central Europe, where tariffs are part of a regulated global

tariff, the first concern is to keep x-border tariffs low

*

Belgian case study

*

ST versus LT pricing differentiation: need for harmonisation, as

TSOs will have to align their practices. If not, cheaper, over

recovering routes will be subsidized by under recovering ones

(see example);

*

Multipliers: unlike foreseen in KEMA 2009 study, Fluxys monthly

multipliers vary in a small range, from 0.5 to 2.6.

*

General discussion on the questions

*

On Cost allocation

Cost allocation & determination of reference prices are the same

issue. Various cost allocation methodologies of e.g. short term versus

long term products costs can trigger in some cases inter-TSO cross

subsidization; various E/E splits will distort inter-Hub competition.

Regarding the cost drivers (for the cost allocation):

*

LRMC is just a cost driver. As it needs to be adjusted for

cost-recovery, it cannot constitute a pure approach in any way.

*

The transmission systems are designed so that there is no

physical congestion; contractual congestions come from system

users not using the capacity they booked.

2 experts underline that they have no experience of an issue resulting

from the coexistence of 2 different tariff approaches.

*

On cross-subsidies

*

General discussion on how cross-subsidies should be tackled in

the Framework Guideline: should it not be tackled? Should it be

tackled only via high level principles, and leave it for the

NRAs and ACER to monitor? At this stage, this question remains

open.

*

Domestic versus Transmission: define 2 macroscopic envelopes or

go closer to “cost-service” equivalence? In case the first

approach is favored, how to ensure that the envelopes are of the

correct size? One issue, which influences the size of national

envelops, is the definition of a distribution network.

*

LT versus ST – it is considered by many experts that the shift

to the shorter term is today an important issue. However, it is

not possible to predict that it will remain so. In any case, if

one TSO goes for short term under recovery, other TSOs will have

to do the same.

*

On multipliers it was discussed that multipliers equal to 1 or

different from 1 will trigger cross-subsidies between LT & ST

products.

*

On Cost Recovery

*

How do we cover variable costs? – developing ST markets goes

along with increasing variable costs that need to be covered.

*

Price instability will affect supply, consumers and buyers.

*

On incentives to use the system efficiently

*

2 experts underline that in electricity, tariff used to follow a

“pay as used” approach; however, now, everyone thinks that

transmission capacity should have a value (because of i.e. large

needs to invest in cross-border power transmission).

*

On the Cost of Implementing the FG:

*

Situations when shippers have to renegotiate LT contracts are

costly;

*

Apart from LRMC, which might trigger consequent implementation

costs, all other options would have limited costs;

*

One identified cost is the revenue loss when merging zones.

*

The actual costs may depend on whether a dedicated platform was

developed specifically for cross-border use.

*

Policy options that minimise the need for future change will

drive down the costs.

6/6

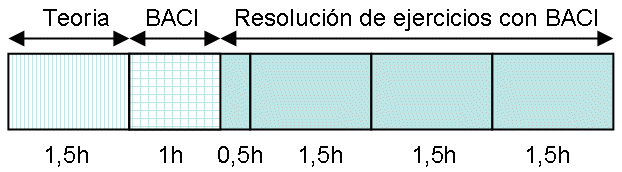

DOCENCIA EN SINCRONIZACIÓN DE PROCESOS CON JBACI Y TUTORIZACIÓN

DOCENCIA EN SINCRONIZACIÓN DE PROCESOS CON JBACI Y TUTORIZACIÓN THE INTERNATIONAL COUNCIL FOR THE EXPLORATION OF THE SEA

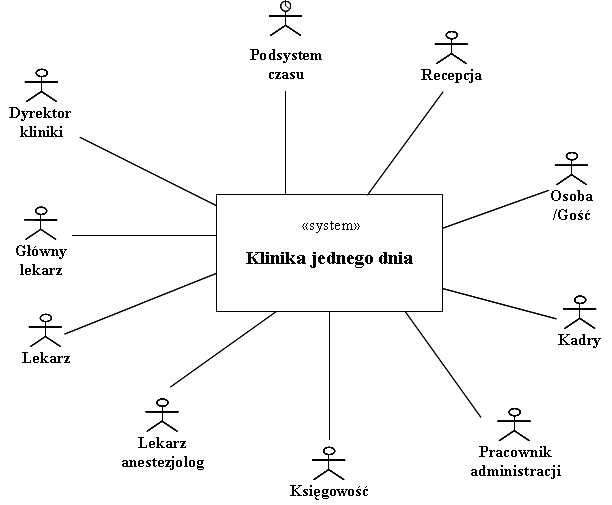

THE INTERNATIONAL COUNCIL FOR THE EXPLORATION OF THE SEA ROZWIĄZANIA DO SPRAWDZIAN 1 14032011 – 20032011 POLECENIA 1

ROZWIĄZANIA DO SPRAWDZIAN 1 14032011 – 20032011 POLECENIA 1 2 KOLO PRIJÍMANIA NA BAKALÁRSKY ŠTUDIJNÝ PROGRAM PRIESTOROVÉ PLÁNOVANIE

2 KOLO PRIJÍMANIA NA BAKALÁRSKY ŠTUDIJNÝ PROGRAM PRIESTOROVÉ PLÁNOVANIE RELAZIONE MORALE DEL CONSIGLIO DIRETTIVO DI REGGIO CALABRIA DELL’UNIONE

RELAZIONE MORALE DEL CONSIGLIO DIRETTIVO DI REGGIO CALABRIA DELL’UNIONE 35 CHAPTER III RESEARCH METHODOLOGY A RESEARCH DESIGN BEFORE

35 CHAPTER III RESEARCH METHODOLOGY A RESEARCH DESIGN BEFORE