rd instruction 1951-c table of contents page 1 part 1951 - servicing and collections subpart c - offsets of federal payments to

RD Instruction 1951-C

Table of Contents

Page 1

PART 1951 - SERVICING AND COLLECTIONS

Subpart C - Offsets of Federal Payments to USDA Agency Borrowers

Table of Contents

-----------------

Sec. Page

1951.101 General. 1

1951.102 Standards and procedures for administrative

offset. 1

1

1951.103 - 1951.105 [Reserved]

1951.106 Offsets of payments to entities related to debtors. 1

(a) General. 1

(b) Offsetting entities. 2

(c) Other remedies. 2

(d) See 7 FLP, Part 3 2

1951.107 - 1951.110 [Reserved] 2

1951.111 Salary offset. 3

(a) Authorities. 3

(b) Definitions. 4

(c) Feasibility of salary offset. 6

(d) Notice to debtor. 6

(e) Notice requirement before salary offset. 7

(f) Debtor's request for records, offer to repay,

request for a hearing or request for information

concerning debt settlement. 8

(g) Hearings. 10

(h) Processing delinquent debts. 11

(i) Deduction percentage. 12

(j) Agency/NFC responsibility for other debts. 13

(k) Establishing employees or former employees

defalcation accounts and non-cash credits to

borrower accounts. 13

(05-14-15) PN 476

RD Instruction 1951-C

Table of Contents

Page 2

Sec. Page

(l) Application of payments, refunds and overpayments. 14

(m) Cancellation of offset. 15

(n) Intra-departmental transfer. 15

(o) Liquidation from final checks. 15

(p) Coordination with other agencies. 15

(q) Deductions by the National Finance Center (NFC). 16

(r) Interest, penalties and administrative costs. 16

(s) Adjustment in rate of repayment. 16

1951.112 - 1951.135 [Reserved] 17

1951.136 Procedures for Offset and Cross-Servicing for the

Rural Housing Service (Community Facility Program only)

And the Rural Business-Cooperative Service. 17

1951.137 Procedures for Treasury Offset and Cross-Servicing

for the Farm Service Agency (FSA) Farm Loan Program 18

1951.138 - 1951.149 [Reserved] 19

1951.150 OMB control number. 19

oOo

RD Instruction 1951-C

PART 1951 - SERVICING AND COLLECTIONS

Subpart C - Offset of Federal Payments to USDA Agency Borrowers

§ 1951.101 General.

Federal debt collection statutes provide for the use of

administrative, salary, and Internal Revenue Service (IRS) offsets by

government agencies, including the Farm Service Agency (FSA), Rural

Housing Service (RHS) for its community facility program, and Rural

Business-Cooperative Service (RBS), herein referred to collectively as

"United States Department of Agriculture (USDA) Agency," to collect

delinquent debts. Any money that is or may become payable from the

United States to an individual or entity indebted to a USDA Agency may

be subject to offset for the collection of a debt owed to a USDA

Agency. In addition, money may be collected from the debtor's

retirement payments for delinquent amounts owed to the USDA Agency if

the debtor is an employee or retiree of a Federal agency, the U.S.

Postal Service, the Postal Rate Commission, or a member of the U.S.

Armed Forces or the Reserve. Amounts collected will be processed as

regular payments and credited to the borrower's account. USDA Agencies

will process requests by other Federal agencies for offset in

accordance with § 1951.102 of this subpart. This subpart does not

apply to direct single family housing loans, direct multi-family

housing loans, and the Rural Utilities Service. Section 1951.136 of

this subpart only applies to the RHS for its community facility

program and the RBS for the offset of Federal payments. Nothing in

this subpart affects the common law right of set off available to USDA

Agencies.

§ 1951.102 Standards and procedures for administrative offset.

General. Collections of delinquent debts through administrative offset

will be taken in accordance with 7 CFR part 3, subpart B and §

1951.106. See 7-FLP, Part 3

§§ 1951.103 - 1951.105 [Reserved]

§ 1951.106 Offsets of payments to entities related to debtors.

(a) General. Collections of delinquent debts through administrative

offset will be in accordance with 7 CFR part 3, subpart B, and

paragraphs (b) and (c) of this section.

_____________________________________________________________________________

DISTRIBUTION: WSAL Account Servicing

Servicing and Collections

1

-

(05-14-15) PN 476

RD Instruction 1951-C

§ 1951.106 (Con.)

(b) Offsetting entities. Collections of delinquent debts through

administrative offset may be taken against a debtor’s pro rata share

of payments due any entity in which the debtor participates when:

(1) It is determined that FSA, FLP has a legally enforceable right

under state law or Federal law, including program regulations at 7 CFR

792.7(l) and 1403.7(q), to pursue the entity payment;

(2) A debtor has created a shell corporation before receiving a loan,

or after receiving a loan, established an entity, or has reorganized,

transferred ownership of, or otherwise changed in some manner the

debtor’s operation or the operation of a related entity for the

purpose of avoiding payment of the FSA, FLP debt or otherwise

circumventing Agency regulations;

(3) Assets used in the entity’s operation include assets pledged as

security to the Agency that have been transferred to the entity

without payment to the Agency of the value of the security or Agency

consent to transfer of the assets;

(4) A corporation to which a payment is due is the alter ego of a

debtor; or

(5) A debtor participates in, either directly or indirectly, in the

entity as determined by FSA.

(c) Other remedies. Nothing in this section shall be deemed to limit

remedies otherwise available to the Agency under other applicable law.

(d) See 7-FLP, Part 3

§§ 1951.107 - 1951.110 [Reserved]

2

-

RD Instruction 1951-C

§ 1951.111 Salary offset.

Salary offset may be used to collect debts arising from delinquent

USDA Agency loans and other debts which arise through such activities

as theft, embezzlement, fraud, salary overpayments, under withholding

of amounts payable for life and health insurance, and any amount owed

by former employees from loss of federal funds through negligence and

other matters. Salary offset may also be used by other Federal

agencies to collect delinquent debts owed to them by employees of the

USDA Agency, excluding county committee members. Administrative

offset, rather than salary offset, will be used to collect money from

Federal employee retirement benefits. For delinquent FLP direct loans,

salary offset will not begin until the borrower has been notified of

servicing options in accordance with 7 CFR Part 766. In addition, for

FLP direct loans, salary offset will not be instituted if the Federal

salary has been considered on the farm operating plan, and it was

determined the funds were to be used for another purpose other than

payment on the USDA Agency loan. For FLP guaranteed debtors, salary

offset can not begin until a final loss claim has been paid. When

salary offset is used, payment for the debt will be deducted from the

employee's pay and sent directly to the creditor agency. Not more than

15 percent of the employee's disposable pay can be offset per pay

period, unless the employee agrees to a larger amount. The debt does

not have to be reduced to judgment or be undisputed, and the payment

does not have to be covered by a security instrument. This section

describes the procedures which must be followed before the USDA Agency

can ask a Federal agency to offset any amount against an employee's

salary.

(a) Authorities. The following authorities are granted to USDA Agency

employees in order that they may initiate and implement salary offset:

(1) Certifying Officials are authorized to certify to the debtor's

employing agency that the debt exists, the amount of the delinquency

or debt, that the procedures in the United States Department of

Agriculture's (USDA's) regulations regarding salary offsets have been

followed, that the actions required by the Debt Collection Act have

been taken; and to request that salary offset be initiated by the

debtor's employing agency. This authority may not be redelegated.

3

(05-14-15) PN 476

RD Instruction 1951-C

§ 1951.111(a) (Con.)

(2) Certifying Officials are authorized to advise the Finance Office

to establish employee defalcation accounts and non-cash credits to

borrower accounts in cases involving other debts, such as those

arising from theft, fraud, embezzlement, loss of funds through

negligence, and similar actions involving Agency employees.

(3) The Finance Office is authorized to establish defalcation accounts

and non-cash credits to borrower accounts upon receipt of requests

from the Certifying Officials.

(b) Definitions.

(1) Certifying Officials - State Directors; State Executive Directors;

the Assistant Administrator, Finance Office; Financial Management

Director, Financial Management Division; and the Deputy Administrator

for Management, National Office.

(2) Debt or debts - A term that refers to one or both of the

following:

(i) Delinquent debts - A past due amount owed to the United States

from sources which include, but are not limited to, insured or

guaranteed loans, fees, leases, rents, royalties, services, sales of

real or personal property, overpayments, penalties, damages, interest,

fines and forfeitures (except those arising under the Uniform Code of

Military Justice).

(ii) Other debts - An amount owed to the United States by an employee

for pecuniary losses where the employee has been determined to be

liable due to the employee's negligent, willful, unauthorized or

illegal acts, including but not limited to:

(A) Theft, misuse, or loss of Government funds;

(B) False claims for services and travel;

(C) Illegal, unauthorized obligation and expenditures of Government

appropriations;

(D) Using or authorizing the use of Government owned or leased

equipment, facilities supplies, and services for other than official

or approved purposes;

4

RD Instruction 1951-C

§ 1951.111(b)(2)(ii) (Con.)

(E) Lost, stolen, damaged, or destroyed Government property;

(F) Erroneous entries on accounting record or reports; and,

(G) Deliberate failure to provide physical security and control

procedures for accountable officers, if such failure is determined to

be the proximate cause for a loss of Government funds.

(3) Defalcation account - An account established in the Finance Office

for other debts owed the Federal government in the amount missing due

to the action of an employee or former employee.

(4) Disposable pay - Pay due an employee that remains after required

deductions for Federal, State and local income taxes; Social Security

taxes, including Medicare taxes; Federal retirement programs; premiums

for life and health insurance benefits, and such other deductions

required by law to be withheld.

(5) Hearing Officer - An Administrative Law Judge of the USDA or

another individual not under the control of the USDA, designated by

the Certifying Official to review the determination of the alleged

debt.

(6) Non-cash credit - The accounting action taken by the Finance

Office to credit and make a borrower's account whole for funds paid by

the borrower but missing due to an employee's or former employee's

actions.

(7) Salary offset - The collection of a debt due to the United States

by deducting a portion of the disposable pay of a Federal employee

without the employee's consent.

5

-

(05-14-15) PN 476

RD Instruction 1951-C

§ 1951.111 (Con.)

(c) Feasibility of salary offset. The first step the Certifying

Official must take to use this offset procedure is to decide, on a

case by case basis, whether offset is feasible. If an offset is

feasible, the directions in the following paragraphs of this section

will be used to collect by salary offset. If the official making this

determination decides that salary offset is not feasible, the reasons

supporting this decision will be documented in the borrower's running

case record in the case of delinquent debts, or the "For Official Use

Only" file in cases of other debts. Ordinarily, and where possible,

debts should be collected in one lump-sum; but payments may be made in

installments. Installment deductions can be made over a period not

greater than the anticipated period of employment. However, the amount

deducted for a period will not exceed 15 percent of the disposable pay

from which the deduction is made. If possible, the installment payment

will be sufficient in size and frequency to liquidate the debt in

approximately 3 years. Based on the Comptroller General's decisions,

other debts by employees cannot be forgiven. If the employee retires

or resigns, or if employment ends before collection of the debt is

completed, final salary payment, lump sum leave, etc. may be offset to

the extent necessary to liquidate the debt. Salary offset is feasible

if:

(1) The cost to the Government of collecting salary offset does not

exceed the amount of the debt. County Committee members are exempt

from salary offset because the amount collected by salary offset would

be so small as to be impractical.

(2) There are not any legal restrictions to the debt, such as the

debtor being under the jurisdiction of a bankruptcy court, or the

statute of limitations having expired. The Debt Collection Act of 1982

permits offset of claims that have not been outstanding for more than

10 years.

(d) Notice to debtor.

(1) After the Certifying Official determines that collection by salary

offset is feasible, the debtor should be notified within 15 calendar

days after the salary offset determination. This notice will notify

the debtor of intended salary offset at least 30 days before the

salary offset begins. For FLP direct loans, this notice will be sent

after the borrower is over 90 days past due and immediately after

sending notification of servicing rights in accordance with 7 CFR 766.

For FLP guaranteed debtors, this notice will be sent after a final

loss claim has been paid. The salary offset determination notice will

be delivered to the debtor by regular mail. (Revised 01-09-08, PN

417.)

(2) The Debt Collection Act of 1982 requires that the hearing officer

issue a written decision not later than 60 days after the filing of

the petition requesting the hearing; thus, the evidence upon which the

decision to notify the debtor is based, to the extent possible, should

be sufficient for the Agency to proceed at a hearing, should the

debtor request a hearing under paragraph (f) of this section.

6

-

RD Instruction 1951-C

---------------------

§ 1951.111 (Con.)

(e) Notice requirement before salary offset. Salary offset will not be

made unless the employee receives 30 calendar days written notice.

This Notice of Intent (Guide Letter 1951-C-4) will be addressed to the

debtor or the debtor's representative. The Notice of Intent must be

modified if it is addressed to the debtor's representative. In either

case, the Notice of Intent will state:

(1) It has been determined that the debt is owed, the amount of the

delinquency or debt, and the facts giving rise to the debt;

(2) The cost to the Government of collecting salary offset does not

exceed the amount of the debt;

(3) There are not any legal restrictions that would bar collecting the

debt;

(4) The debt will be collected by means of deduction of not more than

15 percent from the employee's current disposable pay until the debt

and all accumulated interest are paid in full;

(5) The amount, frequency, approximate beginning date, and duration of

the intended deductions;

(6) An explanation of the requirements concerning interest, penalties

and administrative costs, unless such payments are waived;

(7) The employee's right to inspect and request a copy of records

relating to the debt;

(8) The employee's right to voluntarily enter into a written agreement

for a repayment schedule with the agency different from that proposed

by the Agency, if the terms of the repayment proposed by the employee

are agreeable with the agency;

(9) That the employee has a right to a hearing conducted by an

Administrative Law Judge of USDA or a hearing official not under the

control of the Secretary of Agriculture, concerning the agency's

determination of the existence or amount of the debt and the

percentage of disposable pay to be deducted each pay period, if a

petition for a hearing is filed by the employee as prescribed by the

Agency;

7

-

(05-14-15) PN 476

RD Instruction 1951-C

§ 1951.111(e) (Con.)

(10) The timely filing of a petition for hearing will stay the

collection proceedings;

(11) That a final decision will be issued at the earliest practical

date, but not later than 60 calendar days after the filing of petition

requesting the hearing;

(12) That any knowingly false or frivolous statements may subject the

employee to disciplinary procedures, or penalties, under the

applicable statutory authority;

(13) Any other rights and remedies available to the employee under

statutes or regulations governing the program for which the collection

is being made;

(14) That amounts paid on or deducted for the debt which are later

waived or found not owed to the United States will be promptly

refunded to the employee unless there are provisions to the contrary;

(15) The method and time period for requesting a hearing; and

(16) The name and address of an official of USDA to whom

communications should be directed.

(f) Debtor's request for records, offer to repay, request for a

hearing or request for information concerning debt settlement.

(1) If a debtor responds to RD Guide Letter 1951-C-4 by asking to

review and copy USDA Agency's records relating to the debt, the

Certifying Official will promptly respond by sending a letter which

tells the debtor the location of the debtor's USDA Agency files and

that the files may be reviewed and copied within the next 30 days.

Copying costs (see RD Instruction 2018-F) will be set out in the

letter, as well as the hours the files will be available each day. If

a debtor asks to have USDA Agency copy the records, a copy will be

made within 30 days of the request. (Revised 6-28-89, PN 111)

8

-

RD Instruction 1951-C

§ 1951.111(f) (Con.)

(2) If a debtor responds to RD Guide Letter 1951-C-4 by offering to

repay the debt, the offer may be accepted by the Certifying Official,

if it would be in the best interest of the Government. RD Form Letter

1951-8 will be used if a repayment offer for an USDA Agency loan or

grant is accepted. Upon receipt of an offer to repay, the Certifying

Official will delay institution of a hearing proceeding until a

decision is made on the repayment offer. Within 60 days after the

initial offer to repay was made, the Certifying Official must decide

whether to accept or reject the offer. This decision will be

documented in the running case record or the "For Official Use Only"

file, as appropriate, and the debtor will be sent a letter which sets

out the decision to accept or reject the offer to repay. If the offer

is rejected, it should be based upon a realistic budget or Farm and

Home Plan and according to the servicing regulations for the type of

loan(s) involved.

(3) If a debtor responds to RD Guide Letter 1951-C-4 by asking for a

hearing on USDA Agency's determination that a debt exists and/or is

due, or on the percentage of net pay to be deducted each pay period,

the Certifying Official will notify the debtor in accordance with

paragraph (g)(3) of this section and request the debtor's case file or

the "For Official Use Only" file.

(4) If a debtor is willing to have more than 15 percent of the

disposable pay sent to USDA Agency, a letter prepared and signed by

the debtor clearly stating this must be placed in the debtor's case

file or the "For Official Use Only" file.

(5) If a debtor who is an USDA Agency borrower requests debt

settlement, the account must be in collection-only status or be an

inactive account for which there is no security. The Certifying

Official must inform the borrower of how to apply for debt settlement.

Any application will be considered independently of the salary offset.

A salary offset should not be delayed because the borrower applied for

debt settlement.

(6) The time limits set in RD Guide Letter 1951-C-4 and in paragraphs

(1), (2), and (3) of this section run concurrently. In other words, if

a debtor asks to review the USDA Agency file and offers to repay the

debt, the debtor cannot take 30 days to ask to review the file and

then take another 30 days to offer to repay. The request to review the

file and the offer to repay must both be made within 30 days of the

date the debtor receives the notification letter.

9

-

(05-14-15) PN 476

RD Instruction 1951-C

§ 1951.111(f) (Con.)

(7) If an employee is included in a bargaining unit which has a

negotiated grievance procedure that does not specifically exclude

salary offset proceedings, the employee must grieve the matter in

accordance with the negotiated procedure. Employees who are not

covered by a negotiated procedure must utilize the salary offset

proceedings as outlined in RD Guide Letter 1951-C-4. The employee must

be informed, in writing, which procedure to follow and, as

appropriate, reference should be made to the appropriate sections of

the negotiated agreement.

(g) Hearings.

(1) A hearing officer must be a USDA Administrative Law Judge or a

person who is not a USDA employee. In order to ensure that a hearing

officer will be available promptly when needed, Certifying Officials

need to make appropriate arrangements with officials of nearby federal

agencies for the use of each other's employees as hearing officers.

(2) Not later than 30 days from the date the debtor receives the

Notice of Intent, (RD Guide Letter 1951-C-4), the employee must file

with the Certifying Official issuing the notice, a written petition

establishing his/her desire for a hearing on the existence and amount

of the debt or the proposed offset schedule. The employee's petition

must fully identify and explain all the information and evidence that

supports his/her position. In addition, the petition must bear the

employee's original signature and be dated upon receipt by the

Certifying Official.

(3) Certifying Officials are responsible for determining if the

employee's petition for a hearing has been submitted in a timely

fashion. Petitions received from employees after the 30-day time

limitation expires will be accepted only if the employee can show the

delay was because of circumstances beyond his/her control or because

of failure to receive notice of the time limitation. Certifying

Officials are required to provide written notification to the employee

of the acceptance or non-acceptance of the employee's petitions for

hearing.

(4) For those petitions accepted, USDA Agency will arrange for a

hearing officer and notify the employee of the time and place of the

hearing. The hearing location should be convenient to all parties

involved. The employee will also be notified that the acceptance of

the petition for hearing will stay the commencement of collection

proceedings. Any payments collected in error due to untimely or

delayed filing beyond the employee's control will be refunded unless

there are applicable contractual or statutory provisions to the

contrary.

10

--

RD Instruction 1951-C

§ 1951.111(g) (Con.)

(5) The hearing will be based on written submissions and documentation

provided by the debtor and USDA Agency unless:

(i) A statute authorizes or requires consideration of waiving the

debt, the debtor requests waiver of the debt, and the waiver

determination turns on an issue of credibility or truth.

(ii) The debtor requests reconsideration of the debt and the hearing

officer determines that the question of the indebtedness cannot be

resolved by a review of the documentary evidence; for example, when

the validity of the debt turns on an issue of credibility or truth.

(iii) The hearing officer determines that an oral hearing is

appropriate.

(6) Oral hearings may be conducted by conference call at the request

of the debtor or at the discretion of the hearing officer. The hearing

officer's determination that the offset hearing is on the written

record is final and is not subject to review.

(7) The hearing officer will issue a written decision not later than

60 days after the filing of the petition requesting the hearing,

unless the employee requests and the Certifying Official grants a

delay in the proceedings. The written decision will state the facts

supporting the nature and origin of the debt, the hearing officer's

analysis, findings and conclusions as to the amount and validity of

the debt, and repayment schedule. Both the employee and USDA Agency

will be provided with a copy of the hearing officer's written decision

on the debt.

(h) Processing delinquent debts.

(1) Form AD-343, "Payroll Action Request," and RD Form Letter

1951-6 will be prepared and submitted by the Certifying Official to

the National Office, Financial and Management Analysis Staff (FMAS),

for coordination and forwarding to the debtor's employing agency if:

(i) The borrower does not respond to RD Guide Letter 1951-C-4 within

30 days.

(ii) The borrower responds to RD Guide Letter 1951-C-4 within 30 days

and

11

--

(05-14-15) PN 476

RD Instruction 1951-C

§ 1951.111(h)(1)(ii) (Con.)

(A) has had an opportunity to review the file, if requested,

(B) has received a hearing, if requested, and

(C) a decision has been made by the hearing officer to uphold the

offset.

(2) A copy of Form AD-343 and RD Form Letter 1951-6 will be sent to

the Finance Office, St. Louis, MO 63103, Attn: Account Settlement

Unit.

(3) If the debtor is an USDA Agency employee, Form Ad-343 will be sent

to the National Office, FMAS, and a copy to the Finance Office, St.

Louis, MO 63103, Attn: Account Settlement Unit. This form can be

signed for the Certifying Official by an employment officer, an

Administrative Officer, or a personnel management specialist, or

signed by the Certifying Official. (Revised 6-28-89, PN 111)

(4) If the debtor has agreed to have more or less than 15 percent of

the disposable pay sent to USDA Agency, a copy of the debtor's letter

(RD Form Letter 1951-8) authorizing this must be attached to Form

AD-343.

(5) Field offices will be notified of payments received from salary

offset by receipt of a transaction record from the Finance Office.

(i) Deduction percentage.

(1) Generally, installment deductions will be made over a period not

greater than the anticipated period of employment. If possible, the

installment payment will be sufficient in size and frequency to

liquidate the debt in approximately 3 years. The size and frequency of

installment deductions will bear a reasonable relation to the size of

the debt and the employee's ability to pay. Certifying Officials are

responsible for determining the size and frequency of the deductions.

However, the amount deducted for any period will not exceed 15 percent

of the disposable pay from which the deduction is made, unless the

employee has agreed in writing to the deduction of a greater amount.

Installment payments of less than $25 per pay period or $50 a month

will be accepted only in the most unusual circumstances.

(2) Deductions will be made only from basic pay, incentive pay,

retired pay, retainer pay, or, in the case of an employee not entitled

to basic pay, other authorized pay. If there is more than one salary

offset, the maximum deduction for all salary offsets against an

employee's disposable pay is 15 percent unless the employee has agreed

in writing to a greater amount. (Revised 11-2-88, PN 97)

12

--

RD Instruction 1951-C

§ 1951.111 (Con.)

(j) Agency/NFC responsibility for other debts.

(1) USDA Agency will inform NFC about other indebtedness by

transmitting to NFC an AD-343. NFC will process the documents through

the Payroll/Personnel System, calculate the net amount of the

adjustment and generate a salary offset notice. This notice will be

sent to the employee's employing office along with a duplicate copy

for the USDA Agency's records. USDA Agency is responsible for

completing the necessary information and forwarding the employee's

notice to the employee.

(2) Other indebtedness falls into two categories:

(i) An agency-initiated indebtedness (i.e. personal telephone calls,

property damages, etc.).

(ii) An NFC-initiated indebtedness (i.e. duplicate salary payments,

etc.). NFC will send the salary offset notice to the employing office.

(k) Establishing employees-or former employees defalcation accounts

and non-cash credits to borrower accounts. In cases where a borrower

made a payment on an USDA Agency account(s) and, due to theft,

embezzlement, fraud, negligence, or some other action on the part of

an USDA Agency employee or employees, the payment is not transmitted

to the Finance Office for application to the borrower's account(s),

certain accounting actions must be taken by the Finance Office to

establish non-cash credits to the borrower's account and an employee

defalcation account.

(1) The Certifying Official will advise the Assistant Administrator,

Finance Office by memorandum to establish a defalcation account. The

memorandum must state the following information:

(i) Employee's name (or former),

(ii) Social Security Number,

(iii) Present or last known address,

(iv) Date of Payment, and

(v) Amount of the defalcation account.

13

--

(05-14-15) PN 476

RD Instruction 1951-C

§ 1951.111(k)(Con.)

(2) If a non-cash credit to a borrower's account(s) is required, the

letter to the Finance Office will include:

(i) Borrower's name and case number,

(ii) Fund Code and Loan Code,

(iii) Date and amount of missing payment,

(iv) Copy of receipt issued for the missing payment, and

(v) Name of employee who last had custody of the missing funds.

(3) To assist and assure proper accounting for defalcation accounts

and non-cash credits, the request should be made at the same time.

Should requests be made separately, be sure to identify appropriately.

(4) The Certifying Official shall furnish a copy of the memorandum and

supporting documentation for paragraphs (k)(l) and (2) of this section

to the Deputy Administrator for Management for distribution to the

Financial and Management Analysis Staff and Employee Relations Branch,

Personnel Division.

(l) Application of payments, refunds and overpayments.

(1) If a debtor is delinquent or indebted on more than one USDA Agency

loan or debt, amounts collected by offset will be applied as specified

on Form AD-343, based on the advantage to agency or debtor. The check

date will be used as the date of credit in applying payments to the

borrower's accounts.

(2) If a court or agency orders USDA Agency to refund the amount

obtained by salary offset, a refund will be requested promptly by the

Certifying Official in accordance with the order by sending RD Form

Letter 1951-5 to the Finance Office. Processing RD Form Letter 1951-5

in the Finance Office will cause a refund to be sent to the debtor

through the county office or other appropriate USDA Agency office. The

debtor is not entitled to any payment of interest on the refunded

amount.

(3) If a debtor does not request a hearing within the required time

and it is later determined that the delay was due to circumstances

beyond the debtor's control, any amount collected before the hearing

decision is made will be refunded promptly by the Certifying Official

in accordance with paragraph (1)(2) above.

14

--

RD Instruction 1951-C

§ 1951.111(l) (Con.)

(4) If USDA Agency receives money through an offset but the debtor is

not delinquent or indebted at the time or the amount received is in

excess of the delinquency or indebtedness, the entire amount or the

amount in excess of the delinquency or indebtedness will be refunded

promptly to the debtor by the Certifying Official in accordance with

paragraphs (1) and (2) above.

(m) Cancellation of offset. If a debtor's name has been submitted to

another agency for offset and the debtor's account is brought current

or otherwise satisfied, the Certifying Official will complete Form

AD-343 and send it to the National Office, FMAS. FMAS will notify the

paying agency with Form AD-343 that the debtor is no longer delinquent

or indebted and to cancel the offset. A copy of the cancellation

document will be sent to the debtor and the Finance Office, Attn:

Account Settlement Unit.

(n) Intra-departmental transfer. When an USDA Agency employee who is

indebted to one agency in USDA transfers to another agency within

USDA, a copy of the repayment schedule should be forwarded by the

agency personnel office to the new employing agency. The NFC will

continue to make deductions until full recovery is effected.

(o) Liquidation from final checks. Upon the determination that an

employee owing a debt to USDA Agency is to retire, resign, or

employment otherwise ends, the Certifying Official should forward a

telegram with the appropriate employee identification and amount of

the debt to the NFC. The telegram should request that the debt be

collected from final salary/lump sum leave or other funds due the

employee, and, if necessary, to put a hold on the retirement funds.

The telegram information should be confirmed by completion of Form

AD-343. Collection from retirement funds will be in accordance with

Departmental Administrative Offset procedures (7 CFR, Part 3, Subpart

B, Section 3.32). (Revised 11-2-88, PN 97)

(p) Coordination with other agencies.

(1) If USDA Agency is the creditor agency but not the paying agency,

the Certifying Official will submit Form AD-343 to the National

Office, FMAS, to begin salary offset against an indebted employee. The

request will include a certification as to the determination of

indebtedness, and that USDA Agency has complied with applicable

regulations and instructions for submitting the funds to the Finance

Office. (See RD Form Letter 1951-6.) (Revised 6-28-89, PN 111)

15

--

(05-14-15) PN 476

RD Instruction 1951-C

§1951.111(p) (Con.)

(2) When an employee of USDA Agency owes a debt to another Federal

agency, salary offset may be used only when the Federal agency

certifies that the person owes the debt and that the Federal agency

has complied with its regulations. The request must include the

creditor agency's certification as to the indebtedness, including the

amount, and that the employee has been given the due process

entitlements guaranteed by the Debt Collection Act of 1982. When a

request for offset is received, USDA Agency will notify the employee

and NFC and arrange for offset. (See RD Form Letter 1951-7).

(q) Deductions by the National Finance Center (NFC). The NFC will

automatically deduct the full amount of the delinquency or

indebtedness if less than 15 percent of disposable pay or 15 percent

of disposable pay if the delinquency or indebtedness exceeds 15

percent, unless the creditor agency advises otherwise. Deductions will

begin the second pay period after the 30-day notification period has

expired unless FSA/RD issues the notice. If FSA/RD issues the notice,

the NFC will begin deductions on the first pay period after receipt of

the Form AD-343.

(r) Interest, penalties and administrative costs. Interest and

administrative costs will normally be assessed on outstanding claims

being collected by salary offset. However, penalties should not be

charged routinely on debts being collected in installments by salary

offset, since it is not to be construed as a failure to pay within a

given time period. Additional interest, penalties, and administrative

costs will not be assessed on delinquent loans until FSA/RD publishes

regulations permitting such charges.

(s) Adjustment in rate of repayment.

(1) When an employee who is indebted receives a reduction in basic pay

that would cause the current deductions to exceed 15 percent of

disposable pay, and the employee has not consented in writing to a

greater amount, FSA/RD must take action to reduce the amount of the

deductions to 15 percent of the new amount of disposable pay. Upon an

increase in basic pay which results in the current deductions to be

less than the specified percentage, FSA/RD may increase the amount of

the deductions accordingly. In either case, when a change is made the

employee will be notified in writing.

(2) When an employee has an existing reduced repayment schedule

because of financial hardship, the creditor agency may arrange for a

new repayment schedule.

16

--

RD Instruction 1951-C

§ 1951.112 - 1951.135 [Reserved]

§ 1951.136 Procedures for Department of Treasury Offset and

Cross-Servicing for the Rural Housing Service (Community Facility

Program only) and the Rural Business-Cooperative Service.

(a) The National Offices of the Rural Housing Service (RHS), Community

Facilities (CF) and the Rural Business-Cooperative Service (RBS) will

refer past due, legally enforceable debts which are over 180 days

delinquent to the Secretary of the Treasury for collection by

centralized administrative offset (TOP), Internal Revenue Service

offset administered through TOP and Treasury's Cross-Servicing

(Cross-Servicing) Program, which centralizes all Government debt

collection actions. A borrower with a workout agreement in place, in

bankruptcy or litigation, or meeting other exclusion criteria, will be

excluded from TOP or Cross-Servicing.

(b) A 60 day due process notice will be sent to borrowers subject to

TOP or Cross-Servicing. The borrower will be given 60 days to resolve

any delinquency before the debt is reported to Treasury. The notice

will include:

(1) The nature and amount of the debt, the intention of the Agency to

collect the debt through TOP or Cross-Servicing, and an explanation of

the debtor’s rights;

(2) An opportunity to inspect and copy the records related to the debt

from the Agency;

(3) An opportunity to review the matter within the Agency or the

National Appeals Division if there has not been a previous opportunity

to appeal the offset; and

(4) An opportunity to enter into a written repayment agreement.

(c) In referring debt to the Department of Treasury the Agency will

certify that:

17

--

(05-14-15) PN 476

-----------------

RD Instruction 1951-C

§ 1951.136(c) (Con.)

(1) The debt is past due and legally enforceable in the amount

submitted and the Agency will ensure that collections are properly

credited to the debt;

(2) Except in the case of a judgment debt or as otherwise allowed by

law, the debt is referred for offset within 10 years after the

Agency's right of action accrues;

(3) The Agency has made reasonable efforts to obtain payment; and

(4) Payments that are prohibited by law from being offset are exempt

from centralized administrative offset.

§ 1951.137 Procedures for Treasury Offset and Cross-Servicing for the

Farm Service Agency (FSA) Farm Loan Program

(a) The Farm Service Agency, Farm Loan Programs, will refer past due,

legally enforceable debts which are over 180 days delinquent to the

Secretary of the Treasury for collection by centralized administrative

offset (TOP), Internal Revenue Service offset administered through TOP

and Treasury's Cross-Servicing (Cross-Servicing) Program, which

centralizes all Government debt collection actions. A borrower with a

workout agreement in place, in bankruptcy or litigation, or meeting

other exclusion criteria, will be excluded from TOP or

Cross-Servicing. Guaranteed debtors will only be referred to TOP upon

confirmation of payment on a final loss claim.

(b) A 60 day due process notice will be sent to borrowers subject to

TOP or Cross-Servicing by the Director of Kansas City Finance Office.

The borrower will be given 60 days to resolve any delinquency before

the debt is reported to Treasury. The notice will include:

(1) The nature and amount of the debt, the intention of the Agency to

collect the debt through TOP or Cross-Servicing, and an explanation of

the debtor’s rights;

(2) An opportunity to inspect and copy the records related to the

debt, from the Agency;

(3) An opportunity to review the matter within the Agency; and

(4) An opportunity to enter into a written repayment agreement.

18

--

RD Instruction 1951-C

§ 1951.137 (Con.)

(c) In referring debt to the Department of Treasury the Agency will

certify that:

(1) The debt is past due and legally enforceable in the amount

submitted and the Agency will ensure that collections are properly

credited to the debt;

(2) Except in the case of a judgment debt or as otherwise allowed by

law, the debt is referred for offset within 10 years after the

Agency's right of action accrues;

(3) The Agency has made reasonable efforts to obtain payment; and

(4) Payments that are prohibited by law from being offset are exempt

from centralized administrative offset.

(d) See 7 FLP, Part 4 and 8.

§§ 1951.138 - 1951.149 [Reserved]

§ 1951.150 OMB control number.

The collection of information requirements in this regulation have

been approved by the Office of Management and Budget and assigned OMB

control number 0575-0119.

oOo

---

19

(05-14-15) PN 476

-----------------

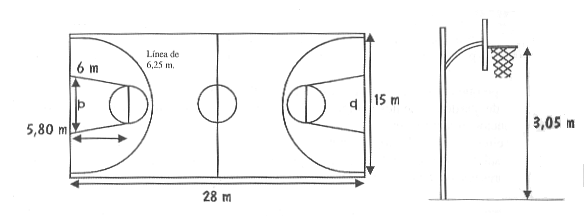

1 HISTORIA DEL BALONCESTO EN 1891 EL DIRECTOR DEL

1 HISTORIA DEL BALONCESTO EN 1891 EL DIRECTOR DEL VERIFICATION OF PENSION OR WORKERS COMPENSATION THIS SECTION TO

VERIFICATION OF PENSION OR WORKERS COMPENSATION THIS SECTION TO CONVOCATÒRIA MOBILITAT ERASMUS + ACCIÓ (KA107) A PAÏSOS NO

CONVOCATÒRIA MOBILITAT ERASMUS + ACCIÓ (KA107) A PAÏSOS NO F ORMULARIO ÚNICO NACIONAL DE SOLICITUD DE PERMISO DE

F ORMULARIO ÚNICO NACIONAL DE SOLICITUD DE PERMISO DE PLAN DE CONTINGENCIAS LOGÍSTICAS OFICINA DE PLANEACIÓN BOGOTÁ DC

PLAN DE CONTINGENCIAS LOGÍSTICAS OFICINA DE PLANEACIÓN BOGOTÁ DC LIETUVOS NACIONALINIŲ STENDŲ TECHNINĖ SPECIFIKACIJA PERKAMŲ PASLAUGŲ APIBŪDINIMAS BENDRIEJI

LIETUVOS NACIONALINIŲ STENDŲ TECHNINĖ SPECIFIKACIJA PERKAMŲ PASLAUGŲ APIBŪDINIMAS BENDRIEJI STUDENT LEARNING & EXPERIENCE COMMITTEE RECTANGLE 951 DOCUMENT TITLE

STUDENT LEARNING & EXPERIENCE COMMITTEE RECTANGLE 951 DOCUMENT TITLE TYPY ROZHODOVACÍCH PROBLÉMŮ ROZHODOVÁNÍ PŘEDSTAVUJE JEDNU Z NEJVÝZNAMNĚJŠÍCH AKTIVIT

TYPY ROZHODOVACÍCH PROBLÉMŮ ROZHODOVÁNÍ PŘEDSTAVUJE JEDNU Z NEJVÝZNAMNĚJŠÍCH AKTIVIT 8688032656 274800 8688032656 ACTA NO 01 BOGOTÁ DC DOS

8688032656 274800 8688032656 ACTA NO 01 BOGOTÁ DC DOS SCT96 PAGE 2 WIPO E SCT96 ORIGINAL ENGLISH DATE

SCT96 PAGE 2 WIPO E SCT96 ORIGINAL ENGLISH DATE