what happens once you have the trial? some basic information about stipulated dismissals and post-judgment actions stipulated dismissals:

What happens once you have the trial? Some basic information about

Stipulated Dismissals and Post-Judgment Actions

Stipulated Dismissals:

What is a stipulated dismissal?

A stipulated (agreed) dismissal (see s. 799.24(3) of the Wisconsin

Statutes) happens when the plaintiff and the defendant agree to have

the judge dismiss the action and not enter a judgment against the

defendant only if the defendant pays the plaintiff an agreed upon

amount by a certain date. Once that amount is paid (this can be

accomplished through a payment plan) the case is dismissed.

Why would I want a stipulated dismissal?

A stipulated dismissal means that the defendant doesn’t have a

judgment against them, a real problem when trying to obtain credit in

the future. For the plaintiff, a stipulated dismissal might mean a

better chance at actually getting the money owed to them, especially

if the defendant will need to get a loan to make the payment.

How do you get a stipulated dismissal?

A stipulated dismissal is always a voluntary agreement between the

parties. After the court makes a determination of how much the

defendant should pay, the parties can enter into the agreement and

have it entered as an order by the judge.

What happens if the defendant doesn’t pay by the date in the

agreement?

The plaintiff can file a sworn statement with the court and a judgment

for the original amount will be entered against the defendant without

returning to court.

NOTE: CASES ENDING IN A STIPULATED DISMISSAL ARE STILL LISTED ON

CCAP!!!

Post-Judgment:

==============

Costs:

Can my court costs be reimbursed if I win my case?

Yes, but only some costs. You will not receive reimbursement for lost

wages or transportation but you can receive reimbursement for the cost

to file the case, the cost to serve the summons and petition, to

subpoena witnesses, and for garnishment costs. You can also receive

limited attorney fees. Please see the “Guide to Small Claims Court”

for the amount of reimbursement allowed for attorney fees.

Executing the Judgment:

What happens if there is a judgment entered?

Once a judgment is entered the plaintiff must take some steps to

execute the judgment to get the court’s help in actually receiving the

payment from the defendant.

The first step is getting a financial disclosure from the defendant

(now called the judgment debtor). Note: In Dane County the financial

disclosure is automatically sent to the debtor by the court at the

time of judgment.

The court will order the defendant to complete the form within 15 days

of the judgment and send it directly to the plaintiff. The form does

not need to be sent if the defendant satisfies the judgment (pays the

amount owed to the plaintiff) by the end of the 15 days.

What happens if the form isn’t returned? If the form is not returned

and the judgment isn’t satisfied, the plaintiff can ask that the

defendant be held in contempt. The plaintiff should request form

SC-507, Motion and Order for Hearing on Contempt, and file it with the

court. After this, an order-to-cause hearing will be held and usually

the defendant will have to fill out the financial disclosure form

while at the hearing. If the defendant does not appear, an arrest

warrant can be issued for the defendant and he or she could be placed

in jail or fined for failing to appear in court. One reason the

defendant must fill out a financial disclosure statement is that the

Plaintiff needs to know whether and where to have the judgment

“docketed”.

Docketing the Judgment:

How and why do you docket the judgment?

The plaintiff can have the judgment “docketed” by paying a fee to the

clerk. The clerk will put the judgment on an official, public list.

Docketing a judgment will automatically place a lien on any real

estate the defendant owns for 10 years. Usually the defendant will not

be able to sell the property or get a loan on the property until the

lien is removed by paying the plaintiff the amount of the judgment. A

transcript of the judgment can also be docketed in other counties

where the defendant owns property.

If the defendant doesn’t own any property the plaintiff may want to

use the garnishment process described in the next section to enforce

the judgment.

Appeals:

Small claims actions can be appealed to the court of appeals. There

are no special small claims rules for appeal. It is a complicated

legal process and should probably only be done with the help of an

attorney.

Reopening a Default Judgment (form SC-511, Petition to Answer or to

Reopen Small Claims Judgment and Order):

Default judgments are very common in small claims court. They often

occur when the defendant never appear in court. There are some

circumstances when a default judgment can be reopened, allowing the

defendant to appear in court and defend the action.

When can I file a motion to reopen?

A defendant can file to reopen a default judgment within 6 months of

the judgment being entered for any reason or one year after the

judgment if the case was filed in the wrong county. (see §

799.29(1)(c) of the Wisconsin Statutes). There may be another reason

you can reopen the case under § 806.07 of the Wisconsin Statutes. You

may want to discuss this with an attorney.

Will there automatically be a new trial?

No, there will only be a new trial if the judge finds that “good

cause” for one exists. You must file a notice of motion with the

motion and list the reasons for reopening the case in the notice. Both

the motion and the notice of motion must be served on the other party

and filed with the court. If you do get a new trial you might have to

pay court cost. Be sure to ask those to be waived if you think you

have a good reason for reopening the case.

Can the plaintiff have the case reopened?

Yes, if the case is dismissed because the plaintiff doesn’t appear he

or she file for it to be reopened, but its probably easier to start

over and file the case again.

GARNISHMENT

What is earnings garnishment? Who may garnish my earnings?

A creditor who is trying to collect an unsatisfied civil court

judgment against a debtor may start a garnishment action to recover

the money owed. This may include interest and other costs, which are

deducted from earnings payable to the debtor. (Wis. Stat. § 812.32)

The employer, who makes payment directly to the creditor, is called

the garnishee.

EXAMPLE: If a court finds that you (debtor) owe a former landlord

(creditor) back rent, the landlord can ask the court to order your

employer (garnishee) to pay part of the rent you owe directly to the

landlord. There are limits to the amount that can be taken out of each

paycheck (see below).

How does the garnishment process work?

Once the creditor has obtained a judgment against the debtor, the

creditor can begin garnishment proceedings by paying a fee and filing

a garnishment notice with the court. The creditor must then serve

papers to the debtor and to the debtor’s employer (the garnishee). (§

812.35)

The papers served to the garnishee require that the garnishment begin

in the pay period following receipt of the notice of garnishment.

Unless the debtor takes action, the garnishment will begin.

The papers served to the debtor explain the possible defenses against

the garnishment. The debtor is given a worksheet to help determine

whether his or her household income is under the federal poverty

guidelines. If, after completing the worksheet, the debtor believes

that some or all of his/her wages may be protected from garnishment

(see below), the debtor must file an answer with the garnishee

(employer). The answer form is included in the papers served to the

debtor. (§ 812.37(1))

The garnishee is required to accept as true any defense to the

garnishment offered by the debtor in the answer. (§ 812.37(3))

Are my wages exempt from garnishment?

Normally, 80% of your earnings are protected from garnishment. (§

812.34(2)(a))

Your earnings may be completely exempt from garnishment if your

household income is under the federal poverty guidelines, or if the

garnishment would put your household income under that level. (§

812.34(2)(b)1)

If someone has a judgment against me, can they garnish my SSI or W-2

check?

Any needs-based public assistance, such as SSI or W-2, is exempt from

garnishment. If you received any needs-based public assistance,

including food stamps and/or veterans’ benefits, within 6 months prior

to the garnishment action, or if you are eligible for but do not

receive such benefits, you may also be exempt. (§ 812.34(2)(b)2;

812.30(9))

How much can be taken out of my wages each pay period?

No more than 20% of your net (take-home) wages may be garnished per

pay period. If you are also paying court-ordered child support, this

amount may be increased to 25%. (§ 812.39(2))

What if child support payments are also being deducted from my

paycheck?

Child support payments will always take priority over other

garnishments.

(§ 812.39(2)) If your wages are exempt from further garnishment

because child support payments are already being deducted from your

earnings, the garnishment may begin once your child support payments

are no longer being withheld.

How long will wages be garnished?

The garnishment may continue for each pay period beginning within 13

weeks of the commencement of the garnishment action. If the creditor

and debtor agree, it may be extended for additional 13-week periods.

This is a good idea if the debtor wishes to avoid paying additional

court costs related to the filing of another garnishment action. (§

812.35(5); 812.40)

Can my employer take action against me if my wages are garnished?

It is illegal for an employer to retaliate against you for an earnings

garnishment. If the employer does, you may bring an action for

reinstatement, back wages and benefits, restoration of seniority, or

other relief allowed under the statute.

(§ 812.43)

GRADE 5 MODULE 3B UNIT 1 LESSON 3 USING

GRADE 5 MODULE 3B UNIT 1 LESSON 3 USING ČSAD AUTOBUSY PLZEŇ AS V MALÉ DOUBRAVCE 27 312

ČSAD AUTOBUSY PLZEŇ AS V MALÉ DOUBRAVCE 27 312 PCC IN THE NEWS NEWS WOMENS BADMINTON CAPTURES FIRST

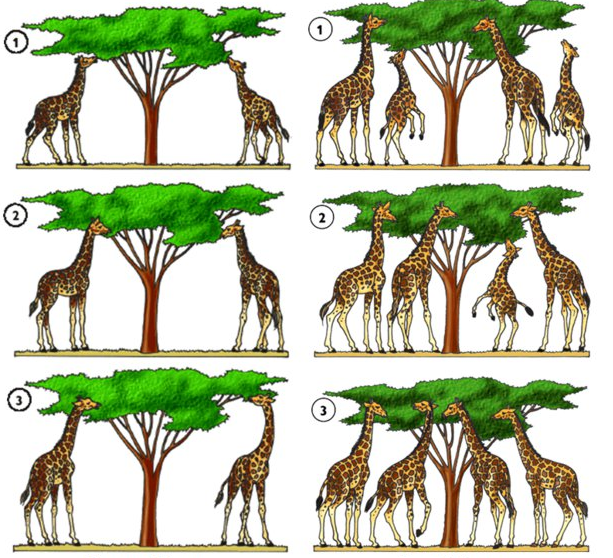

PCC IN THE NEWS NEWS WOMENS BADMINTON CAPTURES FIRST GUÍA 1° AÑO MEDIO”TEORÍAS EVOLUTIVAS” NOMBRE GUÍA N° 4

GUÍA 1° AÑO MEDIO”TEORÍAS EVOLUTIVAS” NOMBRE GUÍA N° 4 TỈNH ỦY KIÊN GIANG BAN TUYÊN GIÁO SỐ

TỈNH ỦY KIÊN GIANG BAN TUYÊN GIÁO SỐ LA “LETTERATURA” CHE TI RIPORTA A DIO A CALCI

LA “LETTERATURA” CHE TI RIPORTA A DIO A CALCI SEITE 6 VON 6 MITTEILUNG DER KOMMISSION ÜBER DIE

SEITE 6 VON 6 MITTEILUNG DER KOMMISSION ÜBER DIE RESERVA DE CRÉDITO Nº MARCAR CON X LO QUE

RESERVA DE CRÉDITO Nº MARCAR CON X LO QUE REGLAMENTO DEL CANAL DE TELEVISIÓN DEL CONGRESO GENERAL DE

REGLAMENTO DEL CANAL DE TELEVISIÓN DEL CONGRESO GENERAL DE REGISTROS ADMINISTRATIVOS (SEGUN LA LEY 3092) ADMINISTRACION DEL ESTADO

REGISTROS ADMINISTRATIVOS (SEGUN LA LEY 3092) ADMINISTRACION DEL ESTADO DETALJNI IZVEDBENI NASTAVNI PLAN I PROGRAM KOD KOLEGIJA

DETALJNI IZVEDBENI NASTAVNI PLAN I PROGRAM KOD KOLEGIJA