s. lee akers, clerk & master eleventh judicial district of tennessee this document is not a definitive statement of the law, is for general

S. Lee Akers, Clerk & Master

Eleventh Judicial District of Tennessee

This document is not a definitive statement of the law, is for general

informational purposes only, is not a substitute for qualified legal

advice, and should in no way be relied upon or construed as legal

advice. If you want specific information on legal issues or wish to

address specific factual situations, you should seek advice from your

lawyer.

Claims – Timely and Proper Filing of Claims and Exceptions

In General

C&M must file all claims submitted after the appointment of a

representative; the filing does not create an inference as to whether

a claim is valid or timely filed. 1 The probate clerk is, however,

required to return unfiled any claim submitted more than 12 months

from Decedent’s date of death. 2

The effect of laws regarding the filing of claims is to require

payment of claims that are prima facie valid. 3

A claim properly (prima facie valid) filed, and timely filed, and

not excepted to within the time allowed has the effect of a judgment

against the estate. 4

The personal representative is not required to file an exception to

a claim void on its face. 5

Exceptions may, and often do, prevail even over claims that are

prima facie valid.

Payment of an estate debt up to $1,000 may be made by the personal

representative without a claim being filed.6 Such payment is made at

personal representative’s peril.

Part 1. Time To File Claim & Exception

Four potential periods in which claims are filed: 7

1.1. Before appointment of a personal representative. The law is

clear. The clerk shall return any claim submitted before the

appointment of a personal representative.8 Therefore, no exception is

made.

1.2 After appointment of a representative and within the time allowed

by T.C.A. § 30-2-306. A Claim submitted within this period is timely

filed provided the claim is filed within one year from decedent’s date

of death.9 The personal representative has until 30 days after the

running of the four month period to file an exception.10

1.3 After the time allowed by T.C.A. § 30-2-306 but before a year from

decedent’s death. These claims are governed by T.C.A. §

30-2-307(a)(1). The creditor must show receipt of actual notice of the

estate administration within the periods described in §§

30-2-307(a)(1)(A) and 30-2-307(a)(1)(B). The burden of proof is upon

the creditor on the issues: i) whether the creditor was known to or

reasonably ascertainable by the personal representative, or ii)

whether actual notice was properly sent in accordance with § 30-2-306.

The personal representative has until 30 days after receiving the

notice from the clerk of the filing of the claim in order to file

exception.11

1.4 More than one year after decedent’s death. All claims must be

filed within one year of decedent’s death.12 As any claim so filed is

barred, no exception is made; the clerk must return any claim filed

more than 12 months sfter Decedent’s death.

The law requiring the filing of claims provides only that exceptions

may be made.13 The alternative presented by the word may appears to be

a) to timely file an exception, or b) to allow the claim to become

final by operation of law. However, the word may only excuses the

filing of an exception when none is required. Miller v. Morelock, 206

S.W.2d 427 (Tenn. 1947) established that claims that are not prima

facie valid need no exception. However, the prudent administrator will

file an exception to any claim deemed invalid for whatever reason.

Part 2. Properly Filed Claims (Prima Facie Valid)

Not only must the claim be timely, as shown above, the claim must be

properly filed, i.e., the claim must be prima facie valid. T.C.A. §

30-2-307(b) establishes minimum requirements for a claim to be

properly filed: “When [a] claim is evidenced by a[n]…instrument, such

instrument or a photocopy…shall be filed; when due by a [Court

Order]…, a copy…certified by the clerk of the court where rendered

shall be filed; and when due by open account, an itemized statement of

the account shall be filed; and [the]…claim shall be verified by

affidavit of the creditor…which affidavit shall state…the claim is a

correct, just and valid obligation of the estate of the decedent, that

neither the claimant nor any other person on the claimant’s behalf has

received payment thereof, in whole or in part, except such as is

credited thereon, and that no security therefor has been received,

except as thereon stated.” Hence, there are 4 circumstances under

which a claim may be submitted:

Prima Facie Valid

Not Prima Facie Valid

2.1 Timely filed

2.2 Untimely filed

2.3 Timely filed

2.4 Untimely filed

2.1 Timely filed; prima facie valid. If the claim is excepted to, a

hearing must be held on the exceptions as they may, and often do,

prevail even over claims that are prima facie valid. If the claim is

not excepted to, the claim will become final after the period to

except.14

2.2 Untimely filed; prima facie valid. Some claims under this heading

may require a hearing; some may not. Certain untimely filed claims

should be summarily dismissed, such as those filed more than 1 year

after decedent’s death. 15 No reason to set a hearing if the claim is

one which cannot be filed. A hearing must be held, however, if there

is a possible exception to untimeliness. E.g. if the claim is filed

after the four months allowed by T.C.A. § 30-2-306 but before a year

from decedent’s death. These claims are governed by T.C.A. §

30-2-307(a)(1). The creditor must show receipt of actual notice of the

estate administration within the periods described in §§

30-2-307(a)(1)(A) and 30-2-307(a)(1)(B). The burden of proof is upon

the creditor on the issues: i) whether the creditor was known to or

reasonably ascertainable by the personal representative, or ii)

whether actual notice was properly sent in accordance with § 30-2-306.

Such a claim could not be summarily dismissed.

2.3 Timely filed; not prima facie valid. A claim not prima facie valid

should not be bootstrapped to the level of a prima facie valid claim

by reason of a hearing, even if there has been no exception filed.

Otherwise there is no need to require a claim to be prima facie valid.

2.4 Untimely filed; not prima facie valid. These claims can be

summarily dismissed.

1 T.C.A. § 30-2-307(d).

2 T.C.A § 30-2-307(d), Acts 2007, Ch. 8, eff. 03/28/07.

3 Miller v. Morelock 206 SW2d 427 (1947).

4 Brigham v Southern Trust Co., 300 SW2d 880 (1957); Warfield v

Thomas’ Estate, 206 SW2d 372 (1947).

5 Miller v. Morelock, 206 S.W.2d 427 (Tenn. 1947).

6 T.C.A. § 30-2-311.

7 There are two exceptions to this. A cause of action is not a “debt”

within the meaning of T.C.A.§ 30-2-307. Cause of action “claims” are

treated in two very distinct ways: 1) those causes of action in suit

at the time of Decedent’s death which are governed by T.C.A. §

30-2-320, and 2) those causes of action commenced after Decedent’s

death which are governed by T.C.A. § 30-2-315(c). Actions pending at

Decedent’s death must be revived within the same time period for

filing claims: i.e., four months from the first date of publication of

notice to creditors [T.C.A. § 30-2-306(b).] as excepted in T.C.A. §

30-2-307(a). T.C.A. § 30-2-320 mandates that the demand is legally

filed against the estate, “at the time of the filing with the

[Probate] [C]lerk…of a copy in duplicate of the order of revivor,

one…of which copies shall be certified or attested, a notation of

which shall be entered by the [Probate] [C]lerk in the record of

claims, as in the case of other claims filed. Pending actions not so

revived against a personal representative within the period prescribed

in 30-2-307(a) shall abate.” The mere filing of a claim in the probate

matter does not constitute proper revival. In those actions commenced

after Decedent’s death, the action must be commenced before the claim

is filed in probate. A “claim” founded on a cause of action pending in

another court is held in abeyance until the final determination of the

independent suit, whereupon, on the filing of a certified copy of the

final judgment in that independent action, the probate court is

authorized to enter judgment accordingly. [T.C.A. § 30-2-315(c).] As

long as the cause of action is timely filed after Decedent’s death,

the claim then filed in probate does not have to meet the requirements

of T.C.A. § 30-2-306(b) as excepted in T.C.A. § 30-2-307(a). But note

the twelve month limitation in T.C.A. § 30-2-310. If there is no

action pending on the cause of action when it is filed as a claim, the

“claim” can be summarily dismissed. Also note: judgments for child

support payments for each child subject to the order for child support

pursuant to this part shall be enforceable without limitation as to

time. T.C.A. § 36-5-103(g), Acts 1997, ch. 551, § 72, July 1, 1997.]

See also Anderson v. Harrison, C/A 02A01-9805-GS00132 (W.S., Jackson,

Jan. 1999).

8 T.C.A. § 30-2-307(d).

9 T.C.A. §§ 30-2-306, 30-2-310.

10 T.C.A. § 30-2-314(a).

11 T.C.A. § 30-2-314(a).

12 T.C.A. § 30-2-310. Limitation on time of filing claims. All claims

are barred after one year from decedent’s death. In fact, if the

estate administration is commenced more than one year from decedent’s

death, notice is not even sent to creditors T.C.A. § 30-2-306(f) and

by T.C.A. § 30-2-310.

13 T.C.A. § 30-2-314.

14 A claim properly filed and not excepted to within the time allowed

has the effect of a judgment against the estate. Brigham v Southern

Trust Co., 300 SW2d 880 (1957).

15 T.C.A. § 30-2-310. Limitation on time of filing claims. All claims

are barred after one year from decedent’s death. In fact, if the

estate administration is commenced more than one year from decedent’s

death, notice is not even sent to creditors T.C.A. § 30-2-306(f) and

by T.C.A. § 30-2-310.

Page 2 of 2 pages.

Claims – Timely and Proper Filing of Claims and Exceptions

Form 119P, Rev. 2007.08.02

PERATURAN PRESIDEN REPUBLIK INDONESIA NOMOR 88 TAHUN 2006 TENTANG

PERATURAN PRESIDEN REPUBLIK INDONESIA NOMOR 88 TAHUN 2006 TENTANG ESTIMADO AGENTE DE VIAJES LE ENVIAMOS EL PROCEDIMIENTO PARA

ESTIMADO AGENTE DE VIAJES LE ENVIAMOS EL PROCEDIMIENTO PARA UNIVERSIDAD PANAMERICANA DE GUATEMALA FACULTAD DE CIENCIAS DE LA

UNIVERSIDAD PANAMERICANA DE GUATEMALA FACULTAD DE CIENCIAS DE LA LGA REPORT COLACOTWAY THE ON TRACK SURVEY 2014 ON

LGA REPORT COLACOTWAY THE ON TRACK SURVEY 2014 ON GEOMETRÍA COMPUTACIONAL – ALGORITMOS II VERSIÓN BETA MARCELO

GEOMETRÍA COMPUTACIONAL – ALGORITMOS II VERSIÓN BETA MARCELO NAME WHAT IS THE POPULATION OF TROUT IN

NAME WHAT IS THE POPULATION OF TROUT IN DENETİM PROSEDÜRÜ 1 AMAÇ BU PROSEDÜRÜN AMACI SISTEM BELGELENDIRME

DENETİM PROSEDÜRÜ 1 AMAÇ BU PROSEDÜRÜN AMACI SISTEM BELGELENDIRME CAMBOYA WTTPRS253 PÁGINA 13 IENTORNO ECONÓMICO 1)INTRODUCCIÓN

CAMBOYA WTTPRS253 PÁGINA 13 IENTORNO ECONÓMICO 1)INTRODUCCIÓN  ZAŁĄCZNIK NR 3 DO ZAPYTANIA OFERTOWEGO NR 114VIDOK UMOWA

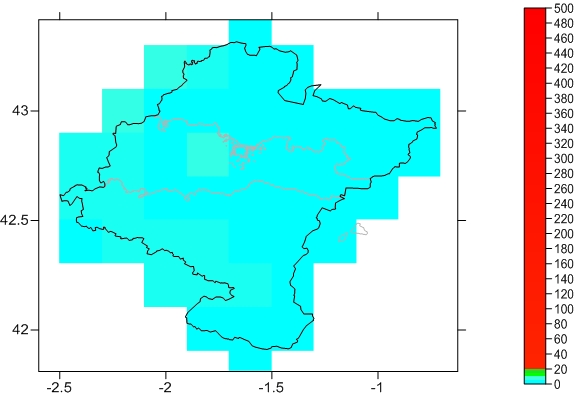

ZAŁĄCZNIK NR 3 DO ZAPYTANIA OFERTOWEGO NR 114VIDOK UMOWA XV NAVARRA FIGURA XV1 CONCENTRACIÓN MEDIA ANUAL DE SO2

XV NAVARRA FIGURA XV1 CONCENTRACIÓN MEDIA ANUAL DE SO2 AMERICAN COLLEGE OF THERIOGENOLOGISTS BASIS FOR POSITION ON MANDATORY

AMERICAN COLLEGE OF THERIOGENOLOGISTS BASIS FOR POSITION ON MANDATORY