theory of the firm produces and sells goods and services objective to maximize profits where profits defined as total revenue minus tot

Theory of the Firm

Produces and sells goods and services

Objective to maximize profits where profits defined as total revenue

minus total costs

Constraints

Technological Constraint – incur costs during production and sales

Market Constraint – revenues limited by consumer demand and competitor

market share

Overview of Market Constraint – Industrial Organization

At one extreme perfect competition, so many competitors that the

individual firm has no control over price

Other extreme is monopoly, a single firm that can influence price

subject to consumer demand

In between are monopolistically competitive and oligopolistic models.

Overview of Technological Constraint

Two time frames – short run, where at least one input’s level remains

fixed, think of day- to-day operations- two inputs, variable and fixed

Long run, where all inputs are variable. This is more of a planning

horizon.

Start with short-run:

Production function with two inputs, labor and capital.

Q = f(L,K) where K is constant. We can only change Q by changing labor

L.

The amount Q changes with an incremental change in L is defined as the

marginal physical product of labor (MPl). MPl = ΔQ / ΔL, holding K

constant.

The following graph shows the relationship between the total product

(production function) and labor’s marginal product. Note that the

horizontal axis measures the amount of labor, while the vertical

measures the amount of output. The shape of the Total Product curve,

the mapping of the production function holding capital constant, shows

output initially increasing at an increasing rate, then hits an

inflection point, increases at a decreasing rate and finally turns

negative. This is as a result of Diminishing Returns which is

demonstrated in the second graph. Marginal product of labor will

initially rise, peak, and then decrease. This phenomenon drives all

the results in the short-run.

The short-run technological constraint is made up of three cost

curves: Average Total Cost (ATC), Average Variable Cost (AVC) and

Marginal Costs (MC). We need to do two things; first we need to define

and derive these curves, and second show their connection to

productivity and diminishing returns.

Define total cost (TC) as the sum of variable and fixed costs (VC,

FC), payments to variable and fixed inputs, respectively.

TC = VC + FC

As noted above, these costs are driven by diminishing returns relating

the productivity of combining variable input to a given amount of

fixed input.

Fixed costs in the following diagram is portrayed as a horizontal

line, in essence these costs are the same regardless of quantity. The

shape of the variable cost curve takes into account diminishing

returns. It rises at a decreasing rate and then increases at an

increasing rate.

Now define marginal costs as the change in total costs due to an

incremental change in output.

MC = Δ TC / ΔQ = (ΔVC + ΔFC)/ΔQ = ΔVC / ΔQ, since ΔFC equals zero.

If we examine ΔVC more closely, VC can change due to two factors.

Assuming Labor (L) as the variable input then payments to variable

input can change if we change the amount of labor or if the wage rate

changes. We will assume the wage remains constant so the following

holds:

ΔVC = w ΔL.

Substituting back into the MC equation we get:

MC = ΔVC / ΔQ = (w ΔL) / ΔQ. Note that ΔL / ΔQ is the inverse of the

MPl. Therefore MC are inversely related to productivity. MC = w / MPl.

The higher the marginal product of labor, i.e., the more productive

labor is, the lower the marginal costs of producing output. This

should make perfect sense.

Average costs

Average costs as the name suggests are costs per unit output. This is

easily derived from the total cost concepts, simply divide by quantity

output. Average total costs (ATC) are then equal to the sum of average

variable (AVC) and average fixed costs (AFC).

TC/Q = VC/Q + FC/Q, or ATC = AVC + AFC

What we will show is that the shape of both AVC and ATC result from,

you guessed it, diminishing returns. First, we need to return to

marginal cost and its inverse relationship with the marginal product

of labor. Recall initially that MPl increases, peaks, and then falls,

this would suggest that marginal cost, as the inverse, would first

fall, bottom out and then increase. In other words, because of

diminishing returns marginal costs are U- shaped. At first, as a

result of increasing MPl the costs of producing more output falls,

after which diminishing returns takes hold and MPl declines, marginal

cost increase.

Before we can derive the average costs curves we need to understand

the relationship between marginals and averages. The best explanation

by example lays close and dear to students’ hearts, their GPA. If your

grade in this class is higher than your GPA, then your GPA will rise.

That is to say that if the marginal is greater than the average, the

average will rise. Of course, the opposite also applies. If the

marginal is below the average then average will fall. Not a good

situation with GPAs but perhaps a good thing if dealing with costs.

As we first begin to combine labor with a given amount of capital, we

become more productive in using capital and MPl increases. Marginal

costs fall, laying below average variable costs, which in turn causes

AVC to fall. As long as MC is below AVC, AVC will continue to fall.

Once MPl peaks, MC turn upwards. MC eventually intersects AVC at the

minimum of AVC. AVC then turns upward as MC now lies above it.

Average fixed costs are a rectangular hyperbola that asymptotes with

both axes. Actually, AFC are very simple. Recall AFC = FC/Q. FC are

constant, so AFC changes as Q changes. Because Q is in the

denominator, as Q becomes increasingly large AFC goes to zero. As the

denominator of a fraction goes to infinity the fraction gets closer

and closer to zero, AFC asymptotes with the horizontal axis. The

reverse also holds true, in that if Q approaches zero, AFC becomes

infinite.

Average total costs are the sum of AVC and AFC. At each Q we add the

heights of the AFC and AVC curves. So at the qith unit of output the

sum of the heights of the blue and red lines equals the height of the

green line. ATC is equal to the sums of AFC and AVC.

We generally do not include the AFC curve in the firm’s short-run

technological constraint since that information is already present at

the vertical distance between ATC and AVC. In other words since ATC =

AVC + AFC, then AFC = ATC – AVC. So in the graph the difference in

heights between the green and red lines is equal to the height of the

blue line.

One last parting shot with the short-run, note that MC intersects ATC

and AVC at their minimums. This relates back to the relationship

between marginals and averages. When they are equal, then it must be

either a maximum or a minimum (excepting inflections) for the average.

Long-Run Technological Constraint

The long-run is a time period where all input levels are variable. In

other words, the oxymoron of a variable fixed input holds. Here the

decision makers not only choose the amount of labor, more importantly

they are choosing the size of the factory. The choice of scale of

operation (factory size) depends on a variety of issues not least of

which is expected demand and technology. The main point to be made is

that the long-run can be thought of as a planning horizon where all

factory sizes are possible. However, once a choice of capital is made

and implemented, then the situation reverts back to the short-run so

at each level of capital there is a family of short-run costs.

There is a concept called long-run average costs (LRAC) where costs

per unit are calculated for each level of capital.

In the graph we have eight short-run ATC curves labeled one through

eight, each with an progressively increasing amount of capital, i.e.,

K1

output. Note that it is either below or in the case of tangencies,

equal to the height of the corresponding short-run curve. The long run

by definition is one where there is no constraining fixed input,

therefore, the firm has greater flexibility in production and

consequently lower average costs.

The LRAC curve also has a characteristic U-shape. The downward sloping

section of the LRAC is called economies of scale. This can be

interpreted by ”bigger being better” with regards to the scale of

operations and average costs. As we move to the right the amount of

capital increases, in other words the size of the factory is larger,

the lower the average costs, the lower the cost per unit output.

Usually these efficiency gains arise from specialization of inputs.

Large scale operations have large production runs. In these cases

inputs can become highly specialized and with high quantities of

output average costs can be low.

The second region of the LRAC is one where LRAC are at a minimum

suggesting all gains from specialization having been exploited. This

is called constant returns to scale. The part of the LRAC that is

upward sloping is called diseconomies of scale, suggesting that the

firm has gotten too big. Increasing the firm’s size results in higher

average costs, hence it would be more efficient on the cost side to

reduce the scale of operations. Note that long-run and short-run costs

are both U-shaped, but for very different reasons: returns to scale in

the long-run and diminishing returns in the short run.

9 PERATURAN KEPALA ARSIP NASIONAL REPUBLIK INDONESIA NOMOR 2

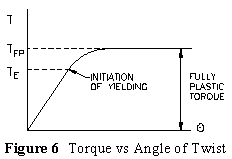

9 PERATURAN KEPALA ARSIP NASIONAL REPUBLIK INDONESIA NOMOR 2 TORSION TESTING WHAT IS A TORSION TEST?

TORSION TESTING WHAT IS A TORSION TEST? Tutorial 22 Converting ced Spike2 or Signal Files to

Tutorial 22 Converting ced Spike2 or Signal Files to A NOTIFICACIÓN SOBRE ACTIVIDADES DE UTILIZACIÓN CONFINADA DE ORGANISMOS

A NOTIFICACIÓN SOBRE ACTIVIDADES DE UTILIZACIÓN CONFINADA DE ORGANISMOS TERMO DE CESSÃO DE DIREITOS AUTORAIS E OUTRAS AVENÇAS

TERMO DE CESSÃO DE DIREITOS AUTORAIS E OUTRAS AVENÇAS L EY DE PARTICIPACIÓN CIUDADANA PARA EL ESTADO DE

L EY DE PARTICIPACIÓN CIUDADANA PARA EL ESTADO DE GRASSROOTS SPORTS ACADEMY SEAGRY SPORTS CLUBS DEAR PARENTSGUARDIANS WE

GRASSROOTS SPORTS ACADEMY SEAGRY SPORTS CLUBS DEAR PARENTSGUARDIANS WE